It’s Friday, you just received wage garnishment orders on behalf of an employee, and you are scrambling to figure out what to do next. We understand that garnishments are confusing. Each garnishment has specific regulations and rules, so it can become overwhelming when you’re dealing with multiple garnishments. Even the most advanced payroll experts sometimes struggle with garnishment prioritization and calculation.

The good news is, we’ve compiled a list of the most common questions and answers employers ask about garnishments. In this article, you will learn what garnishments are and how to prioritize and calculate them. Then, we’ll explain employer responsibilities around garnishments and the steps you can take to ensure compliance.

What Are Wage Garnishments?

Wage garnishments are a legal procedure in which a person’s earnings are required by a court order to be withheld by an employer to pay a debt. Employers must send them to a third-party entity. These funds are continually withheld from employee paychecks until the debt is paid.

Often, wage garnishments come in the forms of child support payments, student loans, and other creditor obligations. However, regardless of the type of garnishment, employees have legal rights around what an employer can and cannot do related to their income.

There are limits on how much an employer can deduct per paycheck and regulations around hiring and firing. So let’s look at the types of garnishments and the laws surrounding each one.

Types of Garnishments

There are two different types of garnishments, garnishments under federal law and garnishments court-ordered by state laws. Federal garnishments consist of bankruptcies, creditor garnishments, federal tax levies, federal administrative garnishments, and federal student loans. Meanwhile, states govern garnishments at the state level, consisting of child support, alimony, state tax levies, local tax levies, and state student loans.

While all garnishments are subject to Title III of the Consumer Federal Protection Act, some state laws differ from Title III, making garnishments more complicated. If a state wage garnishment law differs from Title III, the employer must observe the law resulting in the smaller garnishment. To understand these complexities better, let’s take a look at the different types of federal and state garnishments so that you can handle them with ease.

Federal Garnishments

Federal law mandates creditor garnishments and other federal garnishments. Federal garnishments include levies made by the IRS for unpaid taxes and federal agency administrative garnishments for non-tax debts owed to the federal government.

Non-tax debts are often associated with the U.S. Department of Education on behalf of federal student loans. Let’s take a look at each so you can get a better idea of how to handle federal garnishments.

Bankruptcies

Federal courts handle bankruptcies and follow the U.S. Bankruptcy Code. They are an opportunity for individuals or businesses to reduce their debts while giving creditors the chance to receive some repayment.

If you receive a notification of employee bankruptcy, you are no longer required to withhold income on behalf of the employee to any creditor listed on the discharge order. However, a bankruptcy order doesn’t constitute a waiver of all employee debts. Even if bankruptcy orders consider debts in their decision, they do not impact tax claims, child support, alimony, personal injury debts, and other government debts. The debts waivered will be in the order itself.

Creditors

Creditor garnishments consist of credit card and medical bills, personal loans, and most other consumer debts. However, creditors don’t just start garnishing wages from employees. The first step is to sue an employee for wage garnishment orders. If the employee loses the lawsuit and a court orders a money judgment, the creditor can garnish the wages.

First, you will receive a notice of creditor garnishment on behalf of the employee. Then, you need to notify your employee of the garnishment order before deducting any wages. The creditor will provide you information on how the employee can protest the garnishment. You will then give this information to the employee along with the notice of garnishment.

Federal Tax Levies

If you get a federal tax levy against one of your employees, you must turn over to the IRS any property you have that belongs to that person. In an employer’s case, this comes in the form of wages earned. A federal tax levy is designed to take all of the employee’s wages except for an exempt amount. The IRS determines the exempt amount based on how many dependents, employee claims, and standard deduction claims the employee has.

The IRS will deliver a notice before they begin garnishing, which usually arrives via Form 668-W(ICS) or 668-W(C). Here is a look at the types of levies an employer might receive.

- Forms 668–W(ICS) or 668-W(C)DO levy an individual’s wages, salary (including fees, bonuses, commissions, and similar items), or other income.

- Form 668-W(ICS) and 668-W(C)(DO) provides notice of levy on a taxpayer’s benefit or retirement income.

- Form 668–A(C)DO to levies other property that a third party is holding. For example, the IRS uses this form to levy bank accounts and business receivables.

Employers generally have at least one entire pay period after receiving a Form 668-W(ICS) or 668-W(C)DO before they are required to send any employee wages to the IRS. Once the levy is in place, it runs continuously until the employee pays the debt. -Source IRS

*Note: Encourage your employees that have a federal tax levy to contact the IRS as soon as possible to resolve their tax liability promptly.

Federal Administrative Garnishments

Federal Student Loans

A federal student loan wage garnishment occurs when The U.S. Department of Education sends notice to an employer to subtract up to 15% of an employee’s paycheck to repay student loan debts. For this garnishment to occur, one of the following situations must occur:

- The employee missed at least nine months of federal student loan payments.

- The employee has not responded to communication about defaulted loans.

- The employee has not made arrangements when sent a letter about wage garnishment.

An employer will subtract the wage garnishment after deductions like taxes, Social Security, and Medicare contributions occur. The Department will use this money to pay down employee student loans until one of the following occurs:

- The employee repays the debt.

- The U.S. Department of Education removes the employee from default.

- The employee makes an alternate agreement to repay the loan.

Note: As a result of Covid-19 relief programs, all federal student loan wage garnishments have stopped until at least Sept. 30, 2021

State Garnishments

Child Support/Alimony

Child support is the monetary amount one parent pays to another to support their children financially. Often, the non-custodial parent pays child support to the custodial parent of the child. However, this is not always the case. Child support arrangements vary by state and type of custody ordered.

Note: The Federal Child Support Recovery Act requires (CSRA) requires each state to have garnishment laws that ensure the collection of child support orders.

Alimony is financial support that a court orders a person to give to their spouse during separation or following divorce. This order varies based on financial dependence and support that occurred during the marriage and the needs of each spouse. Each garnishment order should include further instructions detailing how employers need to handle the payments.

State Student Loans

State Tax Levies

Local Tax Levies

People usually pay property tax to the county, school district, local government, or water district. Therefore, individuals pay local tax levies on behalf of the local government. So, why are local tax levies considered a state garnishment? Because local tax levies are governed by state legislation.

While local and state laws mandate these, each garnishment’s regulations are different. Therefore, consult with your local tax expert about these kinds of garnishments.

How Are Garnishments Prioritized?

1. Child Support/Alimony

Child support and alimony court orders have priority over all other garnishments, except federal tax levies. A federal tax levy is prioritized first if it predates the child support or alimony court order. However, if the federal tax levy does not predate the child support order, then even bankruptcy orders can’t stop child support payments.

If an employer receives more than one child support withholding order for the same employee, state laws will guide you on handling both garnishments. If garnishments are from different states, the law applies in the state where the employee works. This scenario usually occurs when the total support withholding exceeds the maximum amount allowed from employee pay.

If you find yourself in this type of scenario, there are solutions. In an attempt to be fair and to not ignore any request for child support, each state has set forth rules on handling multiple garnishment orders and will request one of the following be done:

- The percentages of each garnishment should be determined by a weighted calculation in order to proportionally distribute the maximum withholding amount.

- Setup as one garnishment for the total amount and send 1 check to the state. The state will distribute among multiple orders. Add each Remittance ID number in the Case Number field for reference.

- Percentages should be divided equally among orders.

2. Bankruptcy Orders

3. Federal Tax Levies

Federal tax levies precede all other garnishments except child support orders established before the date of the levy. However, unlike child support orders, federal tax levies can be stopped by a bankruptcy order. They are not subject to withholding limits by the Consumer Credit Protection Act (CCPA) and are governed by the Internal Revenue Service (IRS).

A levy of wages will come from the IRS to the employer. It should include instructions to the employer on how to manage the levy. These include:

- Information on the amount of federal income taxes the employee owes

- Clarification on the kind of tax the employee must pay

- Instructions on calculating the amount exempt from garnishment

- Any amounts exempt from the levy determined by IRS publication 1494

4. Federal Administrative Garnishments

5. Federal Student Loans

The Administrative Wage Garnishment Act handles federal student loans and must be paid to the U.S. Department of Education. The HEA allows the U.S. Department of Education to garnish a percentage of an employee’s disposable income without a court order to repay a student loan. The HEA takes precedence over state law garnishments and requires employers to comply with loan garnishments. Employers that don’t comply with guaranteed student loan garnishments risk being sued for the owed amount.

Note: While child support orders have priority over federal student loans, no other priority guidance is given for federal student loans. The same is true of state student loans. State-issued student loan garnishments may contain specific instructions about the priority of withholding.

6. State Tax Levies

Learn More About State Wage Garnishments

7. Local Tax Levies

8. Creditors & Other Student Loans

Also known as a writ, income execution, or wage attachment, creditor garnishments are usually the lowest in garnishment withholding priority. Title III of the Consumer Credit Protection Act does not address the prioritization of garnishments. Therefore, state law usually governs credit card garnishments.

When an employer receives multiple garnishment orders, the creditors are usually paid one at a time based on the date the garnishment is received. Check the laws of your state. If a state law differs from Title III, you’ll follow the rule that offers a lower employee garnishment amount.

Note: This article does not replace legislative advice. Consult with your local tax authority about any questions or concerns you might have.

What is the Maximum Amount of Wages That Can be Garnished?

Managing garnishment calculations can be complicated. Withholdings differ based on the type of garnishment received and the state in which it is given. However, most garnishment calculations usually start with disposable earnings.

Disposable earnings are what an employee takes home after taxes and qualifying deductions are removed from his/her pay. Disposable earnings consist of employee wages, salaries, commissions, and bonuses. Here is a simple calculation for disposable income. Note, there are some cases where retirement contributions are mandatory by law and also must be deducted to determine disposable income.

Child Support/Alimony Garnishment Withholdings

Under the CCPA, the maximum amount garnished for child support or spousal support is:

- 50% of the employee’s “disposable earnings” if the employee is supporting another spouse and children, or

- 60% if the employee is not supporting another spouse and children.

- These amounts increase to 55% and 65%, respectively, if the employee is at least 12 weeks late (i.e., in arrears) on support payments.

Federal Agency Garnishment Withholdings

As discussed in our previous section, federal agency wage garnishments are prioritized above all other types of withholding orders, except for family court orders. Here’s how to calculate federal agency withholdings:

- Withhold the order amount up to 15% of the employee’s disposable pay Or the amount of the employee’s disposable pay up to 30 times the federal minimum

- If the employee has other garnishments, you will withhold 25% of the employee’s disposable income minus the amounts withheld from previously prioritized garnishments

Student Loan Garnishment Withholdings

According to the Higher Education Act, a lower garnishment limit applies when a federal loan is a student loan. Here is a breakdown of student loan withholdings:

- Federal student loan garnishments require employers to take 10% of an employee’s disposable earnings.

- Other types of loans follow the Debt Collection Improvement Act limit of 15% of an employee’s disposable earnings.

- If an employee has other garnishment orders, 25% of the employee’s disposable earnings go towards student loan garnishments.

Creditor Garnishment Withholdings

The Consumer Credit Protection Act sets limits on how many wages to take out of employee pay. The number of disposable earnings to withhold from an employee’s pay on behalf of collection agencies is determined by taking the lesser of the two options below:

- 25% of your disposable income, if your disposable income is greater than $290

- Any amount greater than 30 times the federal minimum wage

Note: While these rules apply on a national level, some states require a lesser percentage taken out.

Example of Calculating More Than One Withholding Order

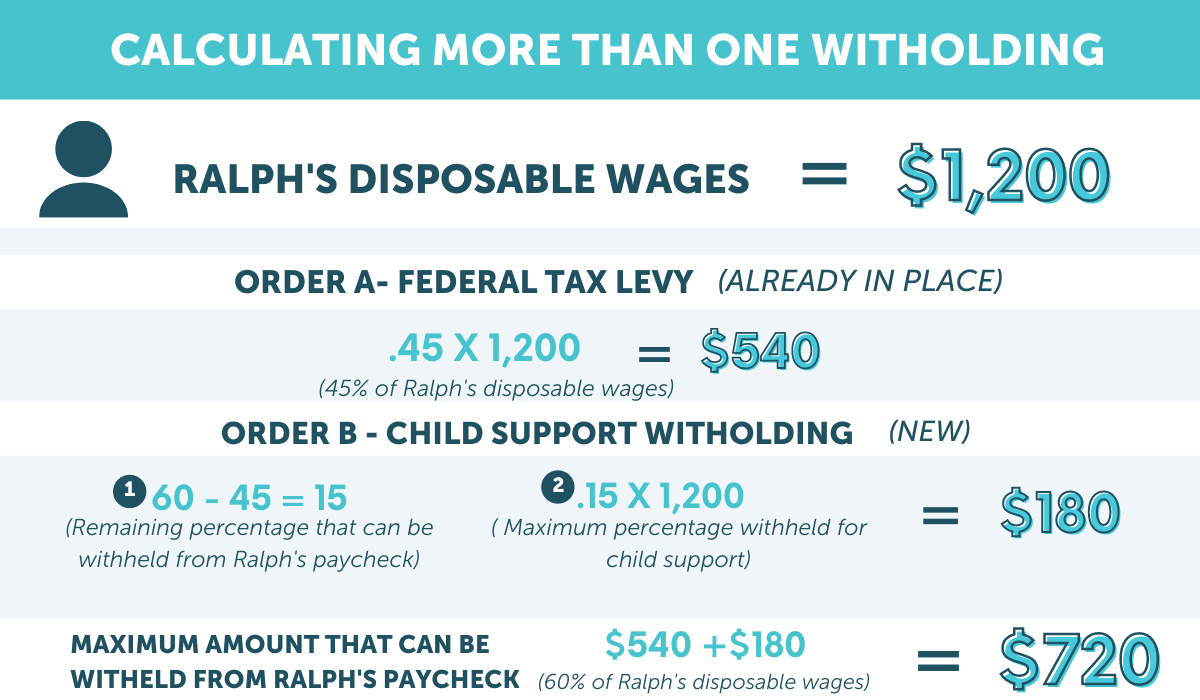

Ralph’s employer receives a child support order. Ralph already has a federal tax levy in place, and his employer is currently withholding 45% of Ralph’s disposable earnings. His employer withholds this garnishment every two-week pay period.

For this example, assume that Ralph’s disposable wages and take-home pay are the same – $1,200. Ralph is not supporting another spouse or family other than the one mentioned in the child support order.

Ralph’s employer may withhold a maximum of 60% of his disposable wages under the CCPA. Therefore, Ralph’s employer may only withhold an additional 15% of his disposable income to satisfy the child support withholding order. Therefore, Ralph’s employer will withhold an additional $180 for the child support garnishment every two weeks. Ralph’s new disposable earnings and take-home pay are now $1,020.

Employer Responsibilities for Garnishment Orders

Now that you know the different types of garnishments and prioritize them let’s review what to do when you receive garnishment orders. As an employer, you are responsible for calculating garnishment amounts, withholding those amounts from employee paychecks, and forwarding payments to the proper entity. You will also continue the garnishment until you receive notice of release.

Let’s take a deeper look at a few of the most common questions we’ve received from employers around garnishments:

Once an employer receives a writ of garnishment, employers are required to withhold the garnishment immediately. However, if an employee contests a garnishment, employers should stop paying to the agency/creditor. Instead, the employer needs to withhold the garnishment amount and send it to the court or agency that issued it.

Certain states even allow employers to pass along administrative expenses associated with wage garnishments to employees. Review your processing fee laws and contact your payroll provider upon receiving a garnishment notice.

The EEOC generally discourages the practice of refusing to hire an employee or firing an employee because of wage garnishment. According to their regulations, employers need only seek information that pertains to a person’s advertised position. Therefore employers should not retaliate against employees because of a single garnishment.

While single garnishments are protected, federal laws don’t protect employees who have multiple garnishments. Some state laws provide more protection against various garnishments, though. Those are Alaska, Arkansas, Utah, Iowa, Massachusetts, Arizona, Florida, Tennessee, Texas, Alabama, Louisiana, Maine, the District of Columbia, and Maryland.

Even so, each state is different. Partnering with a payroll and tax provider who has compliance experts on hand can help. These professionals stay up-to-date on federal and state legislative requirements to help alleviate the burden of garnishment changes.

Several federal benefits are exempt from garnishment orders. Those include:

- Social Security Benefits

- Supplemental Security Income (SSI) Benefits

- Veterans’ Benefits

- Civil Service and Federal Retirement and Disability Benefits

- Military Annuities and Survivors’ Benefits

- Student Assistance

- Railroad Retirement Benefits

- Merchant Seamen Wages

- Longshoremen’s and Harbor Workers’ Death and Disability Benefits

- Foreign Service Retirement and Disability Benefits

- Compensation for Injury, Death, or Detention of Employees of U.S. Contractors Outside the U.S.

Federal Emergency Management Agency Federal Disaster Assistance.

Source: Federal Trade Commission

However, if someone owes federal taxes or student loans, the funds listed above could be used as forms of payment. While other benefits, such as Social Security, might be deducted to pay child support or alimony garnishments. Garnishment laws vary across state lines as well. Luckily, some payroll and HR software providers offer automatic garnishment deductions based on the garnishment type.

How APS Helps With Wage Garnishment Management

At APS, we are passionate about making payroll and HR easier. That’s why we removed the need for our customers to calculate and track garnishments manually. Our system handles garnishment prioritization and automatically calculates the correct withholding amounts from employee pay.

Our approach ensures proper amounts are sent to third-party entities and reduces the potential for costly miscalculation errors. Aside from garnishment prioritization and withholding calculations, we offer comprehensive garnishment management services that include:

- Printing and shipping garnishments on behalf of the client

- Remote printing for other documentations

- The handling of employee deduction payments like child support, creditor garnishments, and other levies each payroll

- Payments mailed to the respective agency on time

- Privacy protection to employees

- Pressure-sealing of deduction checks

- Instructions on how to apply the garnishment payment once the garnishment is received from APS

- A team of dedicated compliance experts, ready to answer any questions you may have

Our cost-effective solution reduces your time spent managing garnishment payments so that you can focus on your employees and business. Schedule a demo with APS and learn more about what we can do to help you with garnishments today!