What You Need to Know About ACA Annual Reporting

On May 24th, 2021, the IRS released the drafts for Forms 1094-C and 1095-C. While there are no changes to Form 1094-C reporting from 2021, there are changes to Form 1095-C. The IRS is planning to publish the final version of these forms in early 2022 for ALEs.

This annual Applicable large employers (ALEs) are required to handle Affordable Care Act (ACA) reporting. An ALE has 50 or more full-time employees and full-time equivalent employees for the tax year 2021.

What are Forms 1094-C and 1095-C?

Form 1094-C: Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns is a form that aggregated large employers (ALE’s) submit to the IRS along with Form 1095-C. Employees do not receive a copy of the 1094-C.

Form 1095-C: Employer-Provided Health Insurance Offer and Coverage is a tax form that identifies the amount of health coverage full-time employees or full-time equivalent employees of ALEs receive. Employees receive a copy of this form from their employer. Employers file this form, so employees do not have to file it with their tax returns. Employees should, however, keep a copy of their financial statements.

What is the Difference Between 1094-C and 1095-C?

The main difference between Form 1094-C and 1095-C is who receives each form. Form 1095-C is sent to both employees and the IRS as it provides information about each employee’s health insurance coverage. Form 1094-C only gets sent to the IRS. It reports information about employer coverage and acts as a cover sheet to transmit Form 1095-C to the IRS.

The information reported on Form 1094-C and Form 1095-C determines whether an employer is potentially liable for payment under the employer shared responsibility provisions of section 4980H and the amount of the payment if any.

Have Questions about ACA Compliance & Reporting?

Changes to Form 1095-C for 2021 Reporting

The individual coverage HRA (ICHRA) is a new health reimbursement account (HRA) introduced in 2020. The revisions previously required employers to alter existing reporting systems and add a second page to Form 1095-C.

But, the 2021 form asks for one page per employee of an ALE member. The IRS has published instructions for Forms 1094-C and 1095-C reporting. Here are the changes to date:*

ADDED CODES ON FORM 1095-C

Code 1T

Line 14 of Form 1095-C now includes Code 1T. IRS draft instructions imply that the code will be used when an employer offers an employee and their spouse (no dependents) an Individual Coverage Health Reimbursement. Affordability of coverage gets determined by using the zip code of the employee’s primary address.

Code 1U

Code 1U is another change to Line 14 of Form-1095. This code also provides an employee and spouse with an Individual Coverage Health Reimbursement. The only difference between code 1U and code 1T is how the affordability of coverage is determined. In Code 1U, affordability of coverage is determined by using the zip code of the employee’s primary worksite.

Note: Neither Code 1T nor Code 1U offer Individual Coverage Health Reimbursements to dependents.

Other Codes:

Codes 1V, 1W, 1X, 1Y, and 1Z are also on Line 14 of Form 1095-C. However, these codes are reserved for future use and await further IRS instructions. The IRS may use these codes for alternative coverage offers, but we will update this article when more information arises.

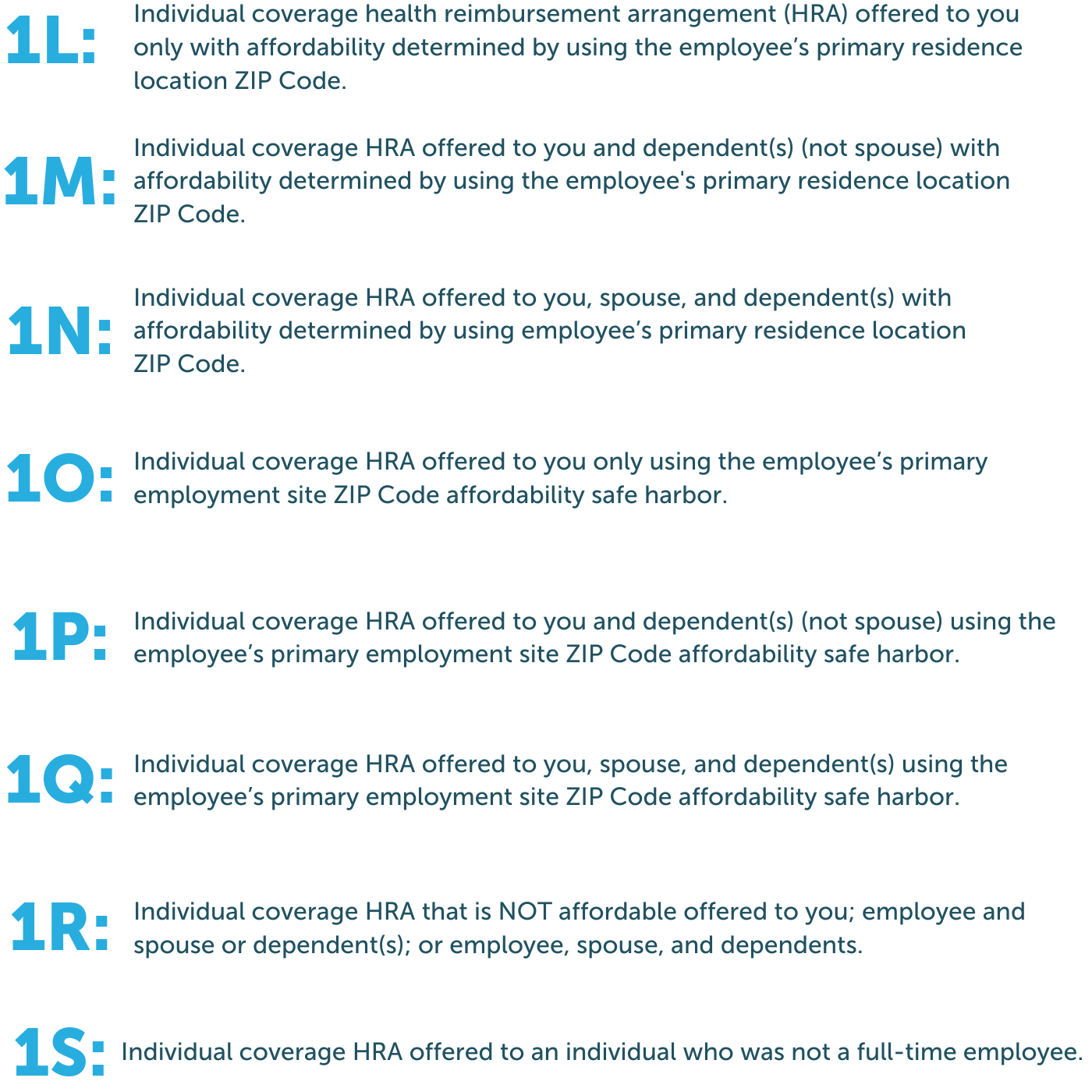

Codes 1L, 1M, 1N, 1O, 1P, 1Q, 1R, 1S were released in 2020 and remain the same for 2021. Here’s a quick breakdown of each:

ACA REPORTING METHODS

1. General Reporting Method

This method requires the most significant amount of information collection. Employers must file a transmittal Form 1094-C for the company and a Form 1095-C for each employee with the IRS. Employees must also receive a copy of Form 1095-C. In addition, ALE Members with employees participating in a self-insured plan can satisfy reporting requirements by filling out Part III of Form 1095-C.

2. Qualifying Offer Method

The Qualifying Offer Method requires less information collection. It is available for employers who offer a “qualifying offer” plan that provides minimum essential coverage and meets the minimum value requirement at a low rate. A qualifying offer plan is where the cost to the individual for employee-only coverage does not exceed 9.5% of the federal poverty level divided by 12. In addition, the employer must offer the plan to all members of the employee’s family to be eligible to use this reporting method.

Using this method, an ALE may provide a simplified statement of coverage to an employee who received a Qualifying Offer for all 12 months of a calendar year. You may use this simplified statement instead of providing a Form 1095-C filed with the IRS.

3. 98% Offer Method

This third method requires the least amount of information collection. It’s available for employers offering affordable coverage and providing minimum value to at least 98% of the company’s full-time employees and their dependents.

The ALE member must certify to the IRS that they met the above requirements. Employers must also file and provide Forms 1095-C for all full-time employees for one or more months of the calendar year.

Employer Reporting Requirements

ALEs are subject to the employer shared responsibility mandate of the ACA. Therefore, they must file a Form 1095-C for each employee who was a full-time employee or full-time equivalent employee for any month of the calendar year. A copy of Form 1095-C must be issued to each full-time employee by January 31st, 2022. Form 1095-C must get filed regardless of whether the ALE offers coverage or the employee enrolls in any health plans offered.

ALEs must file Forms 1094-C and 1095-C with the IRS annually no later than February 28th or March 31st if filing electronically.

Refer to the Questions and Answers about Information Reporting by Employers on Form 1094-C and 1095-C page on the IRS website for more information.

AFFORDABLE CARE ACT REPORTING SUPPORT

If your broker or payroll provider does not provide ACA reporting support, it may be time to consider other options. Ideally, your broker or payroll provider will use a solution that provides the following functionality:

- Automatic population of Forms 1094-C and 1095-C with existing HR and payroll data

- Intelligent algorithms that automatically check for errors in your report information

- Electronic filing of ACA information returns to the IRS on your behalf

If your broker or provider is not providing support for ACA reporting, it is critical to understand how to fill out the forms correctly. It is also essential to check your benefits data for any errors, so reporting is accurate.

COMMON FAQ FOR FORMS 1094-C AND 1095-C

Form 1095-B provides details about an employee’s actual health insurance coverage and includes any dependents covered under an employee’s health care plan. It is provided to the employee by the insurance carrier, not the employer.

Yes, 1095-C forms are still required for the 2021-2022 tax year. ALE members must use these forms to submit health coverage information to the IRS. However, it is good to remind your employees they do not need to wait for these forms to file their taxes.

An ALE Member must furnish a Form 1095-C to each full-time employee by January 31, 2022, for the 2021 calendar year. For more information on alternative furnishing methods for employers, see Qualifying Offer Method.

Independent Coverage HRAs (ICHRAs) were created in June 2019 by the IRS as a way for employers to contribute a set amount of tax-free dollars annually to eligible full-time employees. In addition, per President Trump’s Executive Order No. 13813, employers can reimburse employees for the cost of health insurance coverage purchased in the individual health insurance marketplace using ICHRAs. Therefore, ICHRAs include premium reimbursements for marketplace plans and private insurance.

ALEs can use ICHRAs as a way to comply with ACA health coverage regulations. If ALEs use ICHRA accounts, they must meet the ACA affordability threshold.

For 2021 that threshold meant policy premiums couldn’t exceed 9.83 percent of an employee’s income. That number has decreased in 2022 from 9.83% to 9.61% of an employee’s income.

A full-time employee is an employee who works 30+ hours per week or 130+ hours per month.

Full-time equivalent employees are two or more part-time employees who combined worked the hours of a full-time employee. For example, if two part-time employees work 15 hours each, their combined hours worked for one week are 40 hours. Therefore, those two part-time employees would count as one full-time employee.