As an HR Manager or Payroll Administrator in the healthcare industry, you’re responsible for ensuring employees receive the correct type of pay based on the hours worked. Managing various pay rates, such as shift differential pay, can be challenging, especially if you have to calculate them manually. This process can lead to paycheck errors and, even worse, upset employees.

That’s why it’s essential to understand the various pay rates your employees may be subject to and have a solution to help accurately manage them. Here’s a guide explaining the anatomy of a healthcare employee’s paycheck and what you can do to ensure accurate wages every time.

What Makes Healthcare Payroll Different

As a manager in the healthcare industry, you’re facing constant challenges associated with payroll. These complexities include automatic deductions, on-call time tracking, floating labor distribution, shift differentials, and regulatory compliance. While some of these labor and time tracking factors are associated with most industries, the added challenges of floating employees and shift differentials make healthcare payroll unique.

Unlike your average 9-5 job, healthcare employees work multiple shifts to cover all hours in a day. Managers have to create, assign, and manage schedules for different hours, departments, and units within those departments. This scheduling leads to various shift pay differentials like on-call pay, call-back pay, in-charge pay, overtime pay, and floating employee pay.

In addition to shift differentials and multiple pay rates, the positions associated with each shift are unique. A manager could have a team of registered nurses (RNs), licensed practical nurses (LPNs), emergency medical physicians, etc., all within one unit. These diverse teams make payroll scheduling difficult. Each worker has their own set of credentials and licenses that keep them compliant with healthcare regulations.

If one team member gets sick, filling that person’s shoes is not always easy. Departments may need floating employees or temporary workers regularly. Without a proper payroll solution, these temp workers can create extra work for healthcare managers.

Learn How a Payroll Solution Can Help!

Hospital Shift Differential Pay

What is shift differential pay? It’s essentially the extra compensation an employee receives for hours worked outside of 8:00 am to 5:00 pm, Monday through Sunday. Some healthcare facilities operate 24/7, 365 days a year, and need to staff their locations beyond regular day shift hours adequately.

While the Department of Labor does not require shift differentials, healthcare companies can offer them as a way to fill “undesirable shifts,” including night shifts, holiday shifts, and second and third shifts. Differential shift pay must be included in overtime pay calculations, even though the shift differential pay rates are up to the company.

Calculating Shift Differential Pay

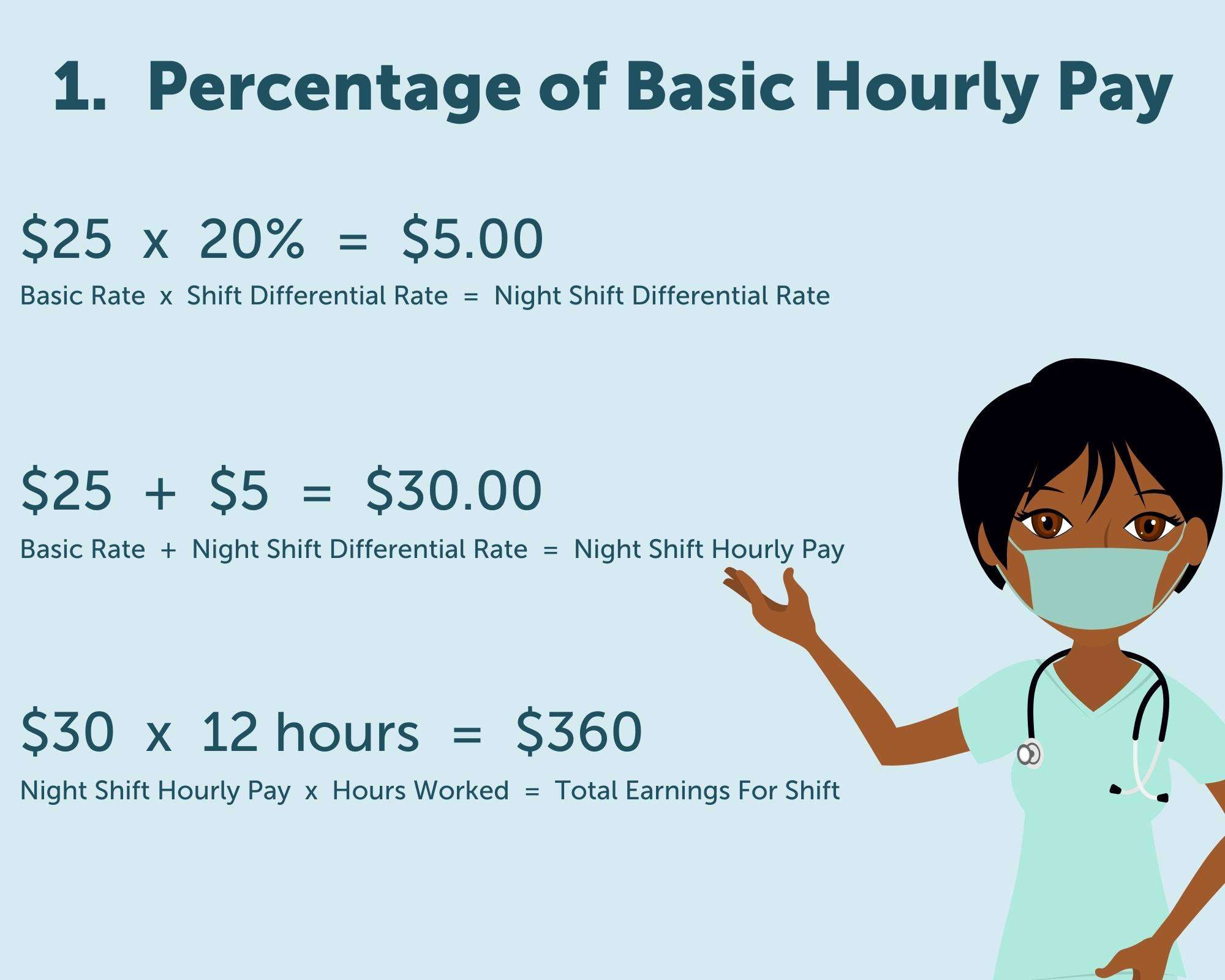

1. Percentage of Basic Hourly Pay

Jane’s new hourly rate for her overnight shift is now $30 per hour ($25 x 20% = $5). Her total earnings for this night shift will be $360 ($30 x 12 hours = $360).

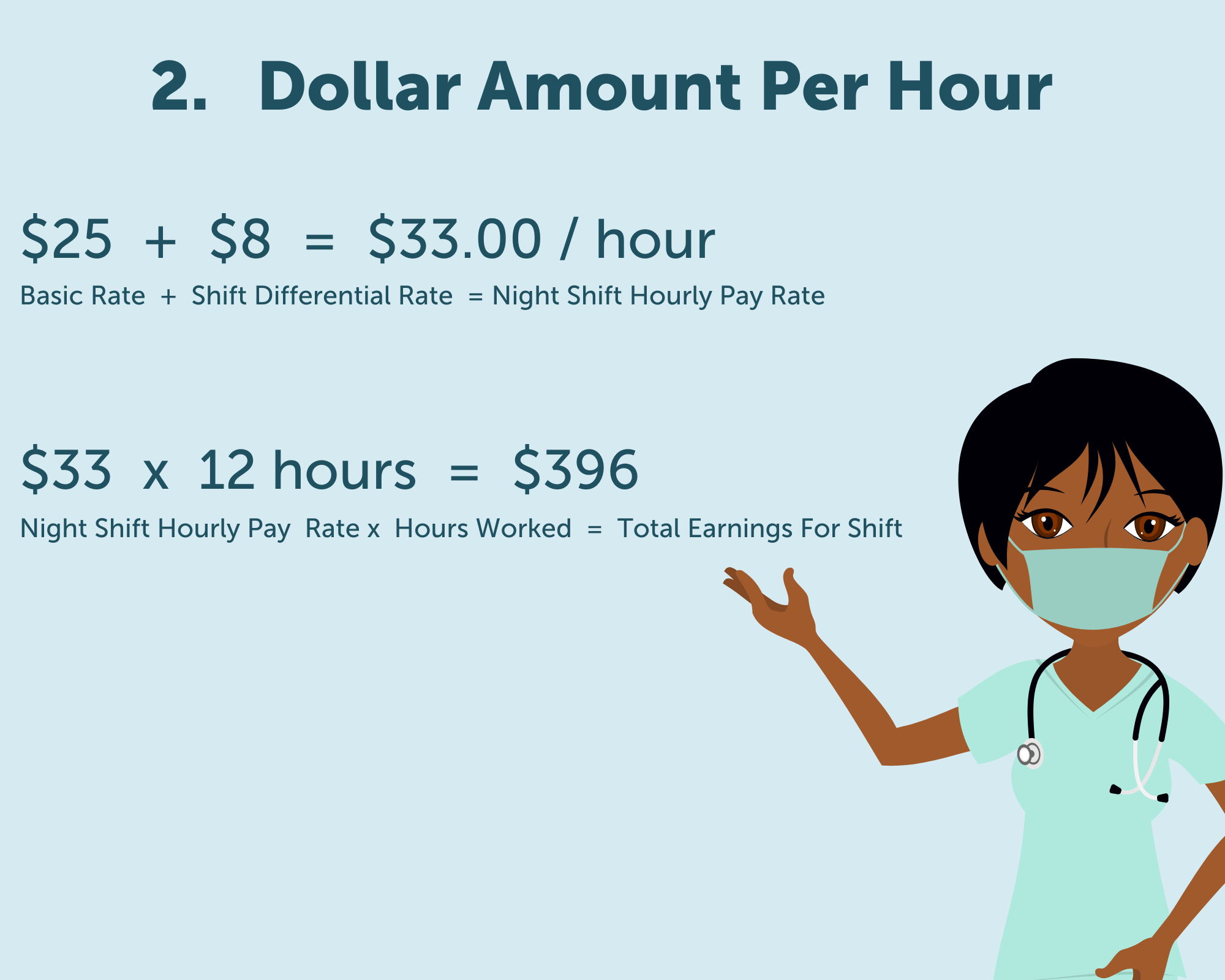

2. Dollar Amount Per Hour

The differential rate is $8 per hour, which means that Jane’s hourly rate is $33 per hour for the night shift. Jane will earn $396 for this shift ($33 x 12 hours = $396).

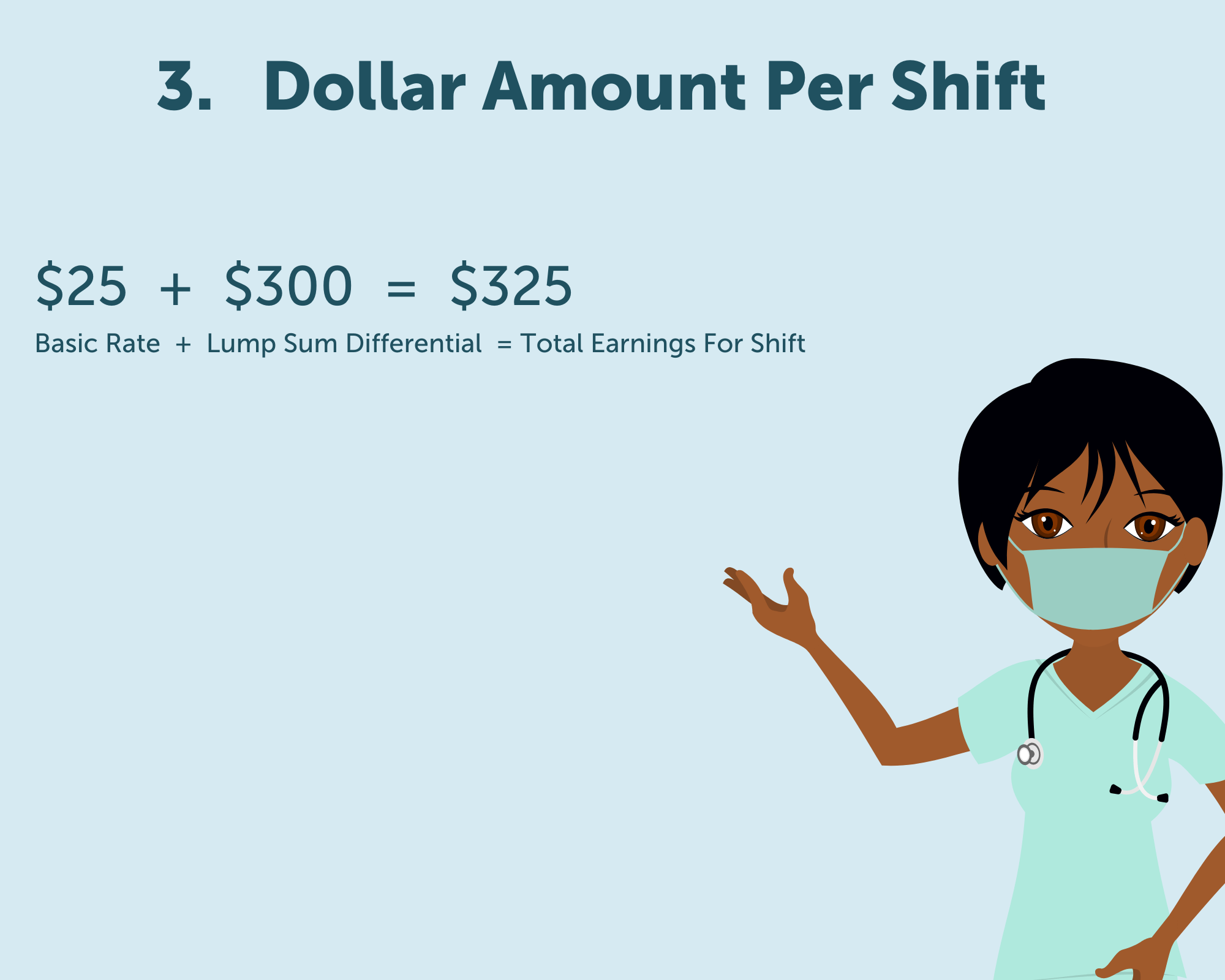

3. Dollar Amount Per Shift

This scenario means that Jane will earn $325 for this night shift ($25 + $300).

Figuring out how much your workers should be earning can be difficult, especially if you offer different pay rates for various shifts. Here are some other things to consider:

- Holiday shifts are usually paid at time and a half (1.5 times the base pay rate).

- The third shift pay differential rate is regularly higher than the second shift pay rate.

- Some companies don’t pay shift differentials and instead offer additional paid time off, pay shift differentials as a cash bonus, or provide premiums within the base salary.

You must be up-to-date on your organization’s shift differential pay policy. Communicate policy changes and make them easily accessible to employees, primarily if new pay rates are implemented, and employees notice changes in their paychecks.

Call-back Pay and On-call Pay

Call-back pay is when an employee has completed their shift and is called back into work. When someone is “on-call,” they must remain on the worksite while working or be within so many miles of the hospital or clinic. On-call employees often can stay home and carry a beeper or cell phone to be reached when needed.

An employee’s call-back pay is based on the specified number of hours’ pay at the current or overtime pay rate. On-call pay only includes the hours the employee worked at the hospital, not the time spent at home.

On-call and call-back shifts are common among healthcare employees, so it’s essential to be familiar with the differentials in pay and verify the actual hours worked. This approach means less time spent correcting payroll errors after processing and a clear call-back pay policy.

Calculating Call-Back Pay

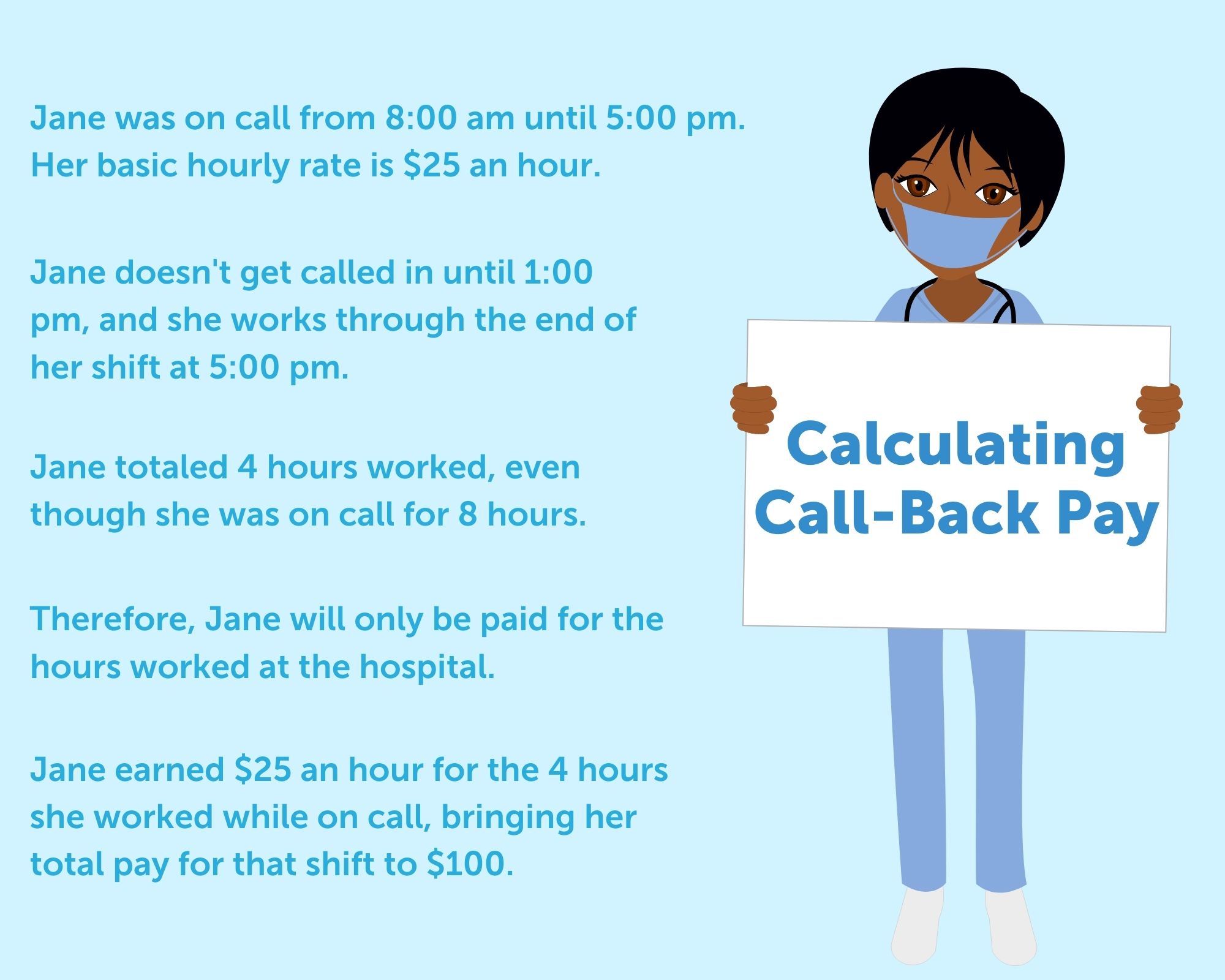

Let’s go back to nurse Jane to understand better how to calculate call-back pay. Jane has worked three 12-hour shifts this week, at 36 total hours worked. Now she is on-call from 8:00 am until 5:00 pm. Since she is on call during regular business hours, she won’t receive any shift differential compensation.

Jane is also required to be within five miles of the hospital. Her home is three miles away, so she decided to stay home and do chores around the house during her on-call time.

Jane doesn’t get called in until 1:00 pm and works at the hospital through the end of her on-call shift until 5:00 pm. She clocks out at 5:00 pm and returns home, totaling 4 hours worked. This scenario brings her total hours worked for the week to 40 hours, which means she does not have to be compensated for overtime.

For her on-call pay, Jane would earn $100 ($25 x 4 hours = $100). Even though Jane was on-call for 8 hours, she only worked at the hospital for 4 hours, so she will only be paid for hours worked on location.

In-Charge Pay

In-charge pay refers to the pay grade for a particular position, such as Pharmacist-In-Charge (PIC) or a Charge Nurse. These employees have sole responsibility for the supervision, management, and state and federal regulations within their department. Whether delegating assignments or ordering medicine, these employees must balance managerial and clinical tasks in their positions.

Employees in these positions play an integral part in healthcare facility operations. They need adequate compensation for the additional duties they are performing. You don’t want to lose these essential employees to a simple error because their pay stubs do not correctly reflect their in-charge pay.

Jane has been promoted to Charge Nurse, which means her pay will be adjusted to reflect her new responsibilities. Unlike other roles where Jane’s income is easily calculated using a formula, in-charge pay is based on qualitative measurements:

- The location at which Jane works

- The level of education she formerly received

- The type of employer for whom she works

- Her experience levels

These are all determining factors for Jane’s in-charge pay. While these factors play a role in calculating Jane’s in-charge pay, her years of experience are the most significant determinant. Payscale.com reports a charge nurse pay differential of more than $9 per hour between a charge nurse’s hourly wage in their first year compared to what a charge nurse with over 20 years of experience can earn.

While the calculation of in-charge pay differs across the board, it’s important to remember that charge nurse compensation isn’t always limited to a paycheck. Many healthcare entities provide alternative benefits such as paid vacation time, sick leave coverage, on-site childcare, and tuition reimbursement to help charge nurses offset their various pay rates.

Department Differential Pay

Employees can work in multiple departments, particularly in the healthcare industry. For example, you could have a nurse who works in the emergency room one day and then in the outpatient clinic the next to ensure sufficient staffing. The pay for working in each of these departments could be entirely different.

Departments in hospitals pay nurses differently if they specialize in a specific certification or have tenure at the healthcare organization. For example, ER nurses pay higher average salaries than ambulatory nurses.

Whether your nurse is covering a shift for a sick employee or the department is short-staffed, notify them beforehand of any potential pay differences. This situation is primarily applicable if they work in a lower-paying department and won’t earn their current department’s income.

Calculating Department Differential Pay:

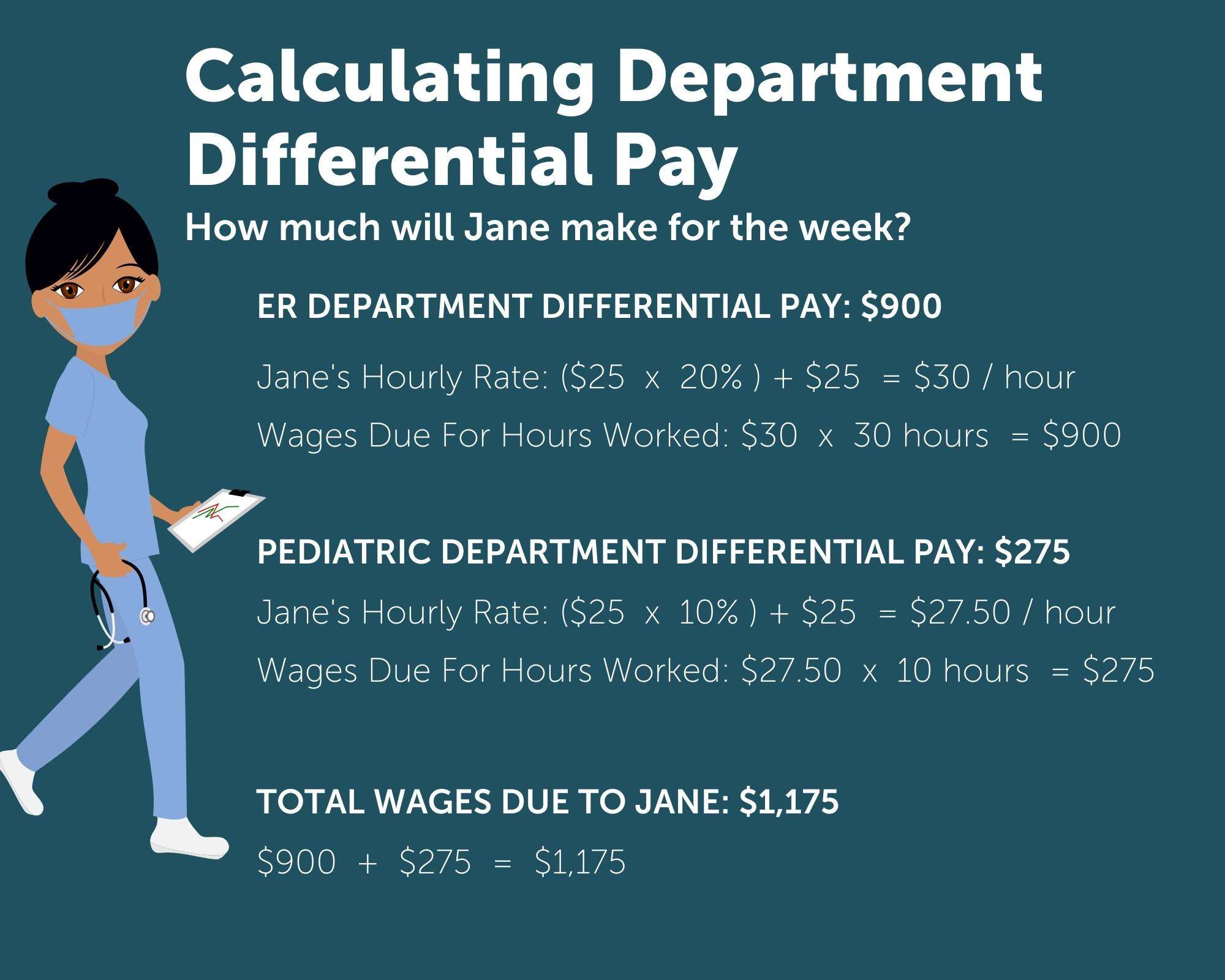

Jane usually works as an ER nurse, but one of her nurse friends who works in the pediatric department is sick. Because Jane is a good friend, she covers for the sick pediatric nurse’s next shift.

However, the hospital has shift differential pay for nurses depending on the department in which they work. This scenario means Jane’s pay for the pediatric shift will be different than her rate in the ER unit.

The ER unit provides a nurse shift differential pay of 20%, while the pediatric unit offers a 10% departmental differential pay. Jane worked 30 hours in the ER and took a 10-hour shift in the pediatric department. Her hourly wage is $25. Here’s a breakdown of Jane’s pay:

Hospital Overtime Pay

Unless exempt, employees covered under the Fair Labor Standards Act (FLSA) are required to receive an overtime rate for time worked over 40 hours in a workweek at no less than 1.5 times their regular pay rate. The FLSA reports there is no limit on the number of hours employees may work in any workweek.

Although working extra hours may not be ideal, the overtime pay with the extra hours can be appealing to some employees. If your department is understaffed and you need additional help, offering overtime pay can lessen the burden of finding service on short notice. However, it’s a good idea to keep an eye on the number of overtime hours your employees are working. You might find that an excess of overtime hours worked for a department warrants an additional hire or shifting of schedules.

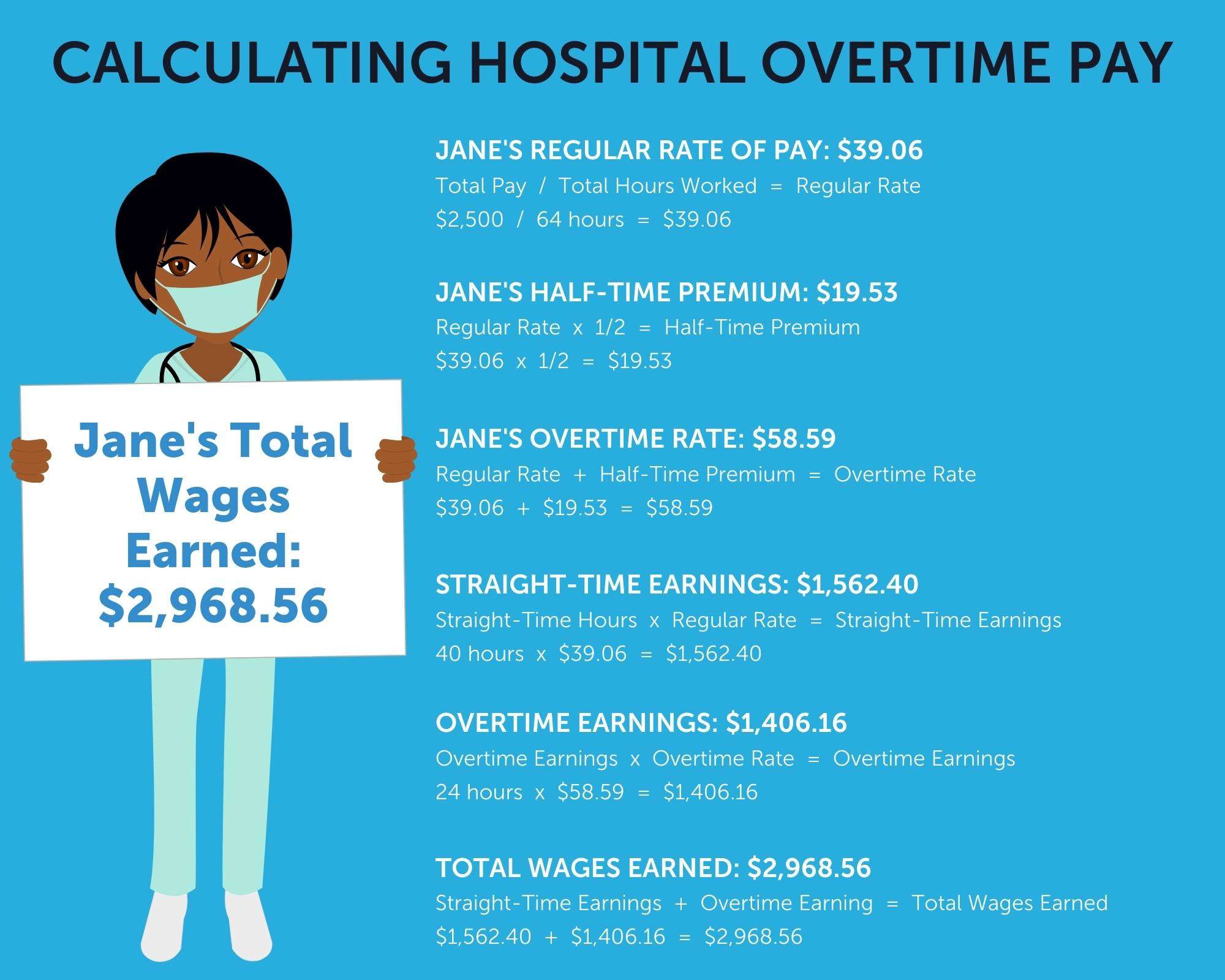

Jane picked up two extra night shifts to help pay off student loan debt, with a night shift differential of $300 per shift. This week, she worked a total of 64 hours at the hospital. Here’s Jane’s time card for the week:

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday | Sunday | |

| Day Shift | 10 | 10 | 10 | 10 | ||||

| Night Shift | 12 | 12 |

According to FLSA, because Jane is considered a non-exempt employee, she must be paid at 150% (time and a half) of her hourly rate of $25 for the additional 24 hours of overtime worked.

One might assume that Jane earned $900 in overtime pay [($25 x 150%) x 24 hours = $900], making her total earnings for the week $2,500 [($25 x 40 hours) + $900 + 600= $2,500] with the total night shift differential of $600 ($300 x 2). However, the calculation is more complex because Jane is a nurse working night shifts with various differentials.

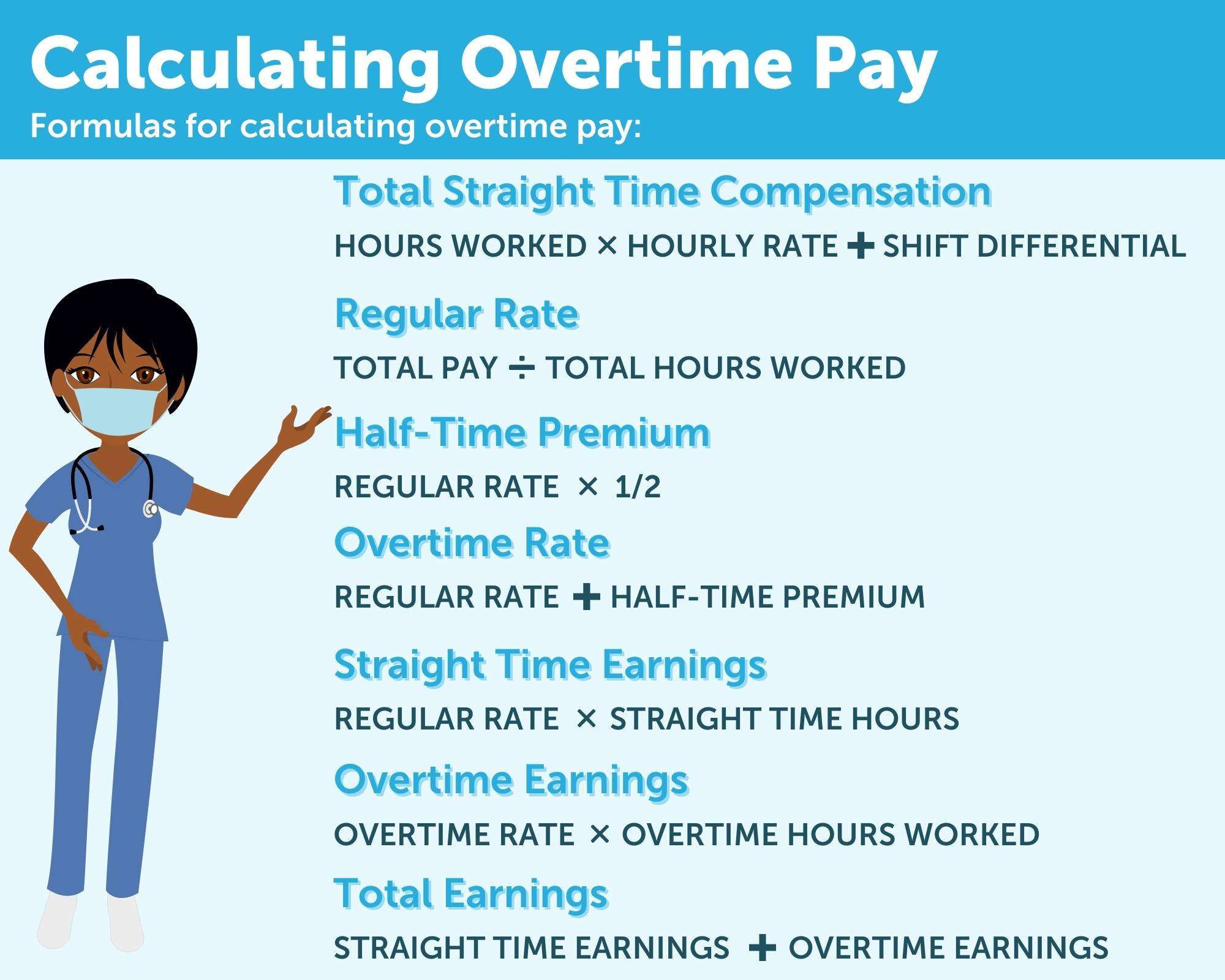

To determine Jane’s pay, we first must calculate her regular rate of pay (RROP). The regular rate equals the total pay in a week divided by the total hours worked in a week. Jane’s regular rate is $39.06 ($2,500 / 64).

Next, we need to calculate Jane’s half-time premium, her regular rate times one-half. Jane’s half-time premium is $19.53 [$39.06 x ½]. Then, add Jane’s half-time premium with her regular rate to find her overtime rate of $58.59 ($39.06 + $19.53).

Now it’s time to calculate the total amount Jane earned with her overtime for the week, which will be her straight-time earnings (ST) plus her overtime earnings. Here are Jane’s total earnings for the week:

THE EIGHT AND EIGHTY (8 AND 80) OVERTIME SYSTEM

The (8 and 80) Overtime System exception in Section 7 (j) of the FLSA gives hospitals and residential care establishments the ability to offer a fixed work period of fourteen consecutive days for computing overtime instead of a 40-hour workweek. Employers pay an employee time and a half for overtime hours worked in excess of 8 hours in a workday and 80 hours in the 14-day period.

Employees must have an agreement or understanding with their employer before working the 8 and 80 schedules. Hospitals and residential care facilities can have some staff under the 8 and 80 rule or the traditional 40-hour workweek, but one employee cannot be subject to both overtime pay methods.

There is an exception to the 8/80 rule. Premium pay for daily overtime above 8 hours may count towards overtime compensation for hours worked beyond 80 in a pay period. Take a look at the example below to explain this concept further:

Jane has agreed to work an 8 and 80 shift instead of the traditional 40-hour workweek. Here’s her timecard for the 14 days:

Week 1:

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday | Sunday | |

| Day Shift | 8 | 8 | 8 | 8 | 8 | 8 (OT) | ||

| Night Shift | 8 (OT) |

Week 2:

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday | Sunday | |

| Day Shift | 8 | 8 | 8 | 8 | 8 | |||

| Night Shift | 8 (OT) |

Jane worked 56 hours during Week 1 and 48 hours during Week 2, bringing her total hours worked for the pay period to 104 hours.

Jane’s overtime in Week 1 would be 16 total hours – 8 for Wednesday’s night shift and 8 for Friday’s day shift. Jane will also earn $300 in night-shift differential pay for Wednesday’s night shift.

For week 2, Jane will have 8 hours of overtime worked for Tuesday’s night shift because she worked more than 8 hours in a single workday. Again, she will earn another $300 differential pay for Tuesday’s night shift.

Here is a breakdown of overtime due to Jane:

- Overtime due for exceeding 8 hours in one day: 16 hours

- Overtime due for exceeding 80 hours in two weeks: 24 hours

- Total overtime due: 24 hours

Why is Jane Owed 24 Hours of Overtime?

Remember, employers can credit overtime over 8 hours in a single day toward overtime pay for hours worked more than 80 hours worked for the two weeks. This rule means Jane’s employer won’t owe her the sum of overtime hours but the larger of the two overtime calculations. So, her total overtime due is only 24 hours, and not 40 hours or 16 hours.

Here are Jane’s total earnings for this pay period:

- Jane’s total straight time compensation = $3,200 (hours worked x hourly rate + night shift differential) [104 hours x $25 + $600]

- Regular rate = $30.78 (total pay / total hours worked) [$3,200 / 104]

- Half-time Premium = $15.39 (regular rate x ½) [ $30.78 x ½)

- Overtime Rate = $46.17 (regular rate + half-time premium) [$30.78 + $15.39]

- Straight time earnings = $2,462.40 (regular rate x straight time hours) [$30.78 x 80]

- Overtime earnings = $1,108.08 (overtime rate x overtime hours worked) [$46.17 x 24]

- Jane’s Total earnings = $3,570.48 (ST earnings + OT earnings) [$2,462.40 + $1,108.08]

*Calculations from DOL Fact Sheet #54 – The Health Care Industry and Calculating Overtime Pay

Using Technology to Streamline Healthcare Payroll

We’ve discussed several types of employee pay rates you may encounter in the healthcare industry, but how do you track and manage them efficiently? We suggest you automate pay rate calculations with payroll and HR technology.

Using multiple systems to calculate and manage different forms of payment is time-consuming and prone to errors. A unified payroll and HR solution with a centralized database helps streamline complex healthcare pay workflows.

An all-in-one software is designed for one-time data entry. The data syncs across your payroll, HR, and attendance workflows, eliminating potential errors. Here are a few more ways the right payroll and HR technology can help you automate even your most challenging workforce processes:

- Advanced clock rules are assigned to employees with shift differentials, overtime pay, and more, saving you valuable time.

- Multiple pay rates are automatically calculated and applied to the correct workers for accurate paychecks and happy employees.

- Advanced scheduling lets you track and manage employee shifts to avoid under or overstaffing while gaining better control of labor expenses.

From shift differential pay to overtime pay, healthcare employers have many types of pay rates to oversee. Managing those pay rates is no longer a headache with the right payroll and HR technology. When you implement a solution that accurately and efficiently pays your employees, you can dedicate your workday to more strategic HR and healthcare-related tasks.

Sources

- Shift Differentials: Compensation for Working Undesirable Hours

- Fact Sheet #53 – The Healthcare Industry and Hours Worked

- PIC Pharmacist In Charge Definition Roles Duties and Responsibilities

- Top Nursing Salaries for Different Types of Nurses

- Wage And Hour Division - Overtime Pay

- What Is A Shift Differential & How To Calculate It | Night Work Overtime

- Shift Differential Pay: How Does It Work?

- How to Calculate Overtime Rates for Shift Differentials

- Clarify Overtime Pay In The Healthcare Industry By Understanding the 80/20 Rule

- How to use the 8/80 rule for overtime pay in the residential health care industry

- Is an 8 and 80 Overtime Schedule Right for my Facility?