As an employer, are you aware of the types of fringe benefits your employee should receive and why? Some employee benefits are legally required for your company to provide, while others are bonuses to entice workers to stay with an organization.

Offering attractive fringe benefits for your current employees may bring unexpected ROIs, such as when they attract others to join the company through word-of-mouth recommendations.

Within this comprehensive guide, you’ll learn:

- The basics of fringe benefits for employers

- The different types of fringe benefits that employers typically offer

- Taxable vs. non-taxable benefits

What are Fringe Benefits?

The Internal Revenue Service (IRS) defines fringe benefits as a form of pay for the performance of services. These employee-related expenses are described in their recent IRS Publication 15-B, the Employer’s Tax Guide to Fringe Benefits. They’re also known as additional forms of workers’ compensation given by the company on top of their official paid salary.

While employers generally pay employees their regular wages, companies can offer fringe benefits to make the job offer more enticing, retain employees, and reward them. Not only are fringe benefits an added boon for employees, but they’re also eligible for tax exemption by employers if the set conditions are met.

Employee fringe benefits differ for every company. Some may choose to offer benefits that reflect the nature of their work. For example, a restaurant might offer meal vouchers, while a health-forward business might give its employees gym memberships. A business might provide a company car to employees who travel frequently.

Not all employees within a company are offered the same fringe benefits. Some senior executives or managers in larger organizations may receive other fringe benefits like overseas travel allowances, access to timeshare properties, and more.

However, not all fringe benefits are optional. Several fringe benefits are required by law for all employers to provide, while some are bonuses. Below, we will explore further law-required fringe benefits, different types of fringe benefits typically offered by employers, and more.

Fringe Benefits that are Required by Law

While some fringe benefits are optional for employers, the law does require a select few. Benefits that protect employee welfare are mandatory, like social security, health insurance, unemployment insurance, medical leave, and workers’ compensation. These may not be benefits that your employees can use monthly, but they serve as a lifeline in the event of accidents or emergencies.

These law-required benefits are in place to safeguard your employees’ livelihood if they’re dismissed from work or suffer from a debilitating health condition. If they cannot earn a salary, these fringe benefits work to sustain them until they gain employment.

Below, we will learn more about mandatory fringe benefits and why they’re legally required to be provided by employers.

Social Security

The original Social Security Act was established in 1935. It is social insurance designed to provide welfare to those with no income, who are retired, or their next-of-kin in the event of death. Social security is funded by a tax that both employers and employees pay. It’s a form of payroll tax required by the Federal Insurance Contributions Act (FICA) and Self-Employed Contributions Act (SECA).

This tax is then applied to the income earned by employees. The employee contribution is taken from a portion of their earned salary, while employers contribute from company funds based on a percentage of their pay.

Social security isn’t a fringe benefit that your employees can utilize immediately. However, its advantages can be seen in the long run when they cannot draw an income from work. 71% of the people who receive social security benefits use it as income for retirement plans.

Health Insurance

Basic health benefits were one of the first modern fringe benefits introduced to employees in the 1930s. Those healthcare benefits later evolved into health care insurance coverage. Health insurance became mandatory for businesses with more than 50 employees based on the Patient Protection and Affordable Care Act (ACA).

Large applicable employers (ALEs) also need to provide healthcare plans that offer minimum essential value and coverage to meet ACA requirements.

Unemployment Insurance

Unemployment insurance is another fringe benefit that your employee may not utilize immediately but will be extremely useful if they lose their job. Under the right conditions, the insurance acts as a form of income for a brief period following the staff’s unemployment. This benefit is legally required based on the Federal Unemployment Tax Act (FUTA).

Employers are required to pay a federal and state unemployment tax to the Department of Labor. The department will then provide wages, training, and career guidance to workers whose employment has been terminated under no fault of their own.

Medical Leave

Similar to health insurance, companies with more than 50 employees are required by law to provide medical leave to employees who have worked for more than a year. According to the U.S. Department of Labor, this falls under the Family and Medical Leave Act (FMLA). This act “provides certain employees with up to 12 weeks of unpaid, job-protected leave per year”.

FMLA also requires the group health benefits of your employees to be maintained while their medical leave is in effect.

Workers’ Compensation

Workers’ compensation is a law-required fringe benefit sanctioned under the U.S. Department of Labor’s Office of Workers’ Compensation Programs (OWCP). The programs provide compensation when workers are injured on the job or suffer from disease due to their occupation.

The program offers four disability compensation programs: medical treatment, vocational rehabilitation, wage replacement benefits, and other related benefits.

Other than the four major disability compensation programs, specific groups of workers are also covered for workplace injuries under the relevant statutes and regulations. It helps aid their financial burden as a result of their injuries. These programs are:

Other Examples of Fringe Benefits

Besides the law-required mandatory fringe benefits mentioned above, employers are also free to offer more fringe benefits to their staff. Most of these fringe benefits are taxable, with a few exceptions.

While optional, most employers usually offer these extra benefits to retain their current staff or attract future employees. This added-on compensation promotes the company as a great place to work while also rewarding its employees for a job well done.

As mentioned before, not all employees within the company receive the same benefits. Most employees will receive the same essential fringe benefits, but certain employees may receive extra compensation based on job role, rank, or seniority.

Below, we’ve listed examples of optional fringe benefits companies may provide their employees.

Life Insurance

As the name suggests, life insurance pays a sum of money to the insured’s dependents or beneficiaries upon their death. Life insurance benefits both the employer and employee, specifically group-term life insurance.

As an employer, you benefit from offering life insurance to your employees because claims do not happen frequently, and the fringe benefit is primarily tax-deductible. Offering life insurance also makes working at your company more enticing. According to the MetLife Annual US Employee Benefit Trends Study 2021, 61% of employees see life insurance as a must-have fringe benefit. Even more so than disability and accident insurance.

Employee Stock Options

Employee Stock Options (ESO) are a type of equity compensation offered to the company’s employees. It allows them the right to buy shares of company stock at “strike price” within a specific time frame. Every company will have its terms stated in the ESO agreement for the employee.

Unlike regular stocks, ESOs are issued by the company and cannot be sold. Startup companies commonly give ESOs as a form of reward to pioneering employees should the company go public.

This fringe benefit works to entice existing employees to stay on, as the ESO will be nullified if the employee leaves the company before the stock is vested. It also becomes an incentive for employees to make the company more successful and go public.

Transportation Benefits

Transportation benefits are a convenient and welcomed compensation for most, if not all, employees. These can come in the form of:

- Monetary allowance to offset the employee’s commute to work

- Transit passes

- Season parking

- Company-provided shuttle vehicles

- Company cars

For many employees, commuting to work is costly. Few live close enough to their place of work and appreciate transportation benefits.

Gym Memberships

This fringe benefit can come in the form of a company-sponsored gym membership or an on-site gym within the place of work. While it’s a perk for employees that enjoy working out, it can also be an excellent incentive to encourage employees to live a healthier lifestyle. If your company’s branding promotes healthy living or physical wellness, offering gym facilities as a fringe benefit would align with their organization’s values.

While gym facilities are directly beneficial to the employee, they also benefit the employer in the long run. Physically healthy employees are less likely to fall ill, which means they take fewer sick days off, allowing your company to continue running efficiently.

Tuition Assistance

Tuition assistance or education reimbursement is another popular fringe benefit offered to employees, especially those that wish to continue with college or academic classes while employed. Not all employees may use this offer, but it is handy for someone who wishes to gain certification that will help advance their role in the company.

For example, a company may offer tuition assistance to staff in their accounting department to get them officially certified as an accountant. It allows them to take on more finance-related responsibilities or helps them be qualified for a promotion to a role that requires a particular certification.

Childcare Reimbursement

Childcare reimbursement, sometimes known as dependent care, is when employers pay for all or a portion of an employee’s childcare expenses. It can be an excellent incentive for employees who are parents of young children. Dependent care gives parents peace of mind knowing they have a portion of their childcare expenses covered while working.

As employers, providing this fringe benefit to your employees shows that you care for their welfare beyond their time at work. It also shows employees and the general public that the company supports working parents.

Achievement Awards

Achievement awards are a great incentive to encourage employees to achieve company goals, whether big or small. These awards may come in a monetary bonus, promotion to a higher position, or a salary increase. It’s also an excellent way to reward employees that go the extra mile, proving their hard work does not go unnoticed by the management.

However, the IRS states special rules for this fringe benefit; achievement awards are exempt up to $1,600 for qualified plan awards and $400 for nonqualified awards. This exclusion applies to the value of any tangible personal property given to your employee as an achievement award. However, it doesn’t apply to cash or cash equivalents such as gift cards, coupons, or gift certificates.

Why Employers Offer Fringe Benefits

It may seem that fringe benefits are more favorable to employees but add to the employer’s budget. However, the company may not project a positive work culture without fringe benefits. Employees want to feel appreciated, and that sentiment goes beyond their regular salary.

Many employees see their job as an extension of their identity — at the end of the day, they crave job satisfaction, and fringe benefits help with that. Here are some of the biggest reasons why providing fringe benefits is vital for companies.

Improves Public Perception

Companies offering enticing fringe benefits to support the welfare of their employees are generally seen in a better light by the public. Customers are more likely to patronize an organization that treats its employees well.

Similarly, stakeholders are more likely to continue supporting organizations favorable in the public eye. At the same time, companies will attract future employees with a more competitive level of compensation.

Boosts Employee Morale

Practical fringe benefits can improve the job satisfaction of employees, which in turn helps with team morale. When employees feel that their efforts are recognized and well-compensated, they’ll be happier and produce better work.

It also helps both parties if the employer recognizes the fringe benefits their employees find helpful. That way, employees can fully use them while the employer doesn’t waste their budget on benefits that employees can’t necessarily utilize.

Better Employee Health and Wellness

In the case of medical and wellness fringe benefits, they’re advantageous in keeping employees physically, emotionally, and mentally well. More companies now offer mental health compensation, which keeps up with the growing awareness of mental wellness.

Companies that help pay for physical and mental wellness keep their employees happy and healthy. When employees are happy and healthy, they’re less likely to take medical leave as often and can keep the company running at optimum efficiency. Physically and mentally fit employees can also work better, resulting in improved productivity.

What Fringe Benefits are Taxable?

As a rule of thumb, all fringe benefits are taxable and must be included in the employee’s pay unless the law explicitly excludes it. Any fringe benefits provided must be included in the employee’s wages.

However, federal income tax, social security, and Medicare taxes will be withheld from the value of the benefit, especially if it’s of significant importance. The fair market value of a fringe benefit will be added to the employee’s gross income and reported on Form W-2 in Box 14. We will discuss fair market value later in the article.

Here are some examples of taxable fringe benefits:

- Cash bonus

- Paid personal time off (PTO)

- Personal use of company-provided vehicles

- Group term life insurance provided above $50,000

- Business frequent-flyer miles converted into cash

What Fringe Benefits are Non-Taxable?

Conversely, non-taxable fringe benefits are not subjected to federal income tax, Social Security, Medicare, and federal unemployment (FUTA) taxes. It also means that employers do not need to report them on Form W-2

Certain taxable benefits can be non-taxable if they don’t reach a certain amount. For example, group term life insurance that exceeds $50,000 will be considered non-taxable. In 2020, a bill was passed noting that student loan relief can be regarded as non-taxable until December 31, 2020.

There are grey areas surrounding non-taxable fringe benefits, but the IRS is the best guide to determine which benefits fall under the category. Here are some examples of non-taxable fringe benefits for your information:

- Employee discounts

- De minimis benefits; meaning fringe benefits that are of low value and given infrequently

- Employee Stock Options (ESO)

- Cafeteria subsidies

- Group term life insurance not exceeding $50,000

- Transportation compensation paid for on the employee’s behalfEmployer-provided cellphones

- Lodging on business premises

How are Fringe Benefits Valued?

The fair market value is commonly used as a guide for valuing fringe benefits. It’s defined as what a buyer would be willing to pay for an item of equal value to the fringe benefit.

Typically, looking at the retail cost of a similar product or service will be able to give you an estimate of the fringe benefit’s fair market value. Although, the employer may have been able to get a discount for a bulk purchase.

An example would be gym access. For taxation purposes, you can use the price of an annual gym membership for reference. In reality, the employer may have negotiated a lower price or corporate discount.

The IRS has provided guidelines on determining the fair market value of fringe benefits.

What is an Accountable Plan?

An accountable plan is a guidebook on benefits reimbursement policies outlined for the employees. This plan details taxable and non-taxable benefits, how employees should claim them, and guidelines for returning excess reimbursements. Businesses generally use these reimbursement methods for fringe benefits, including:

- Transportation mileage

- Purchase of equipment

- Home office expenses

- Meal expenses

- Travel expenses

An accountable plan is an excellent way to have a concise black-and-white policy. Employees have clear guidance of the process, while the employer has receipts for IRS auditing purposes. If your company doesn’t already have one in place, it’s worth considering creating an accountable plan for employee-related expenses.

What are Tax-Advantaged Benefits?

Since most fringe benefits are taxable, employees can’t take full monetary advantage. As an employer, you wouldn’t want to burden your staff with more taxes either. One way to combat this is by introducing tax-advantaged benefits.

Using pre-tax dollars, the employer will pay for a non-taxable benefit that the employee has already paid for with their post-tax income. The employer processes this expense payment in payroll as a tax deduction from the employee’s wages the following month.

Utilizing tax-advantaged benefit programs benefits employees and employers with monetary savings. Refer to the IRS’ Publication 15-B guide to ensure that your method of calculating is accurate.

How to Handle Fringe Benefits on Payroll

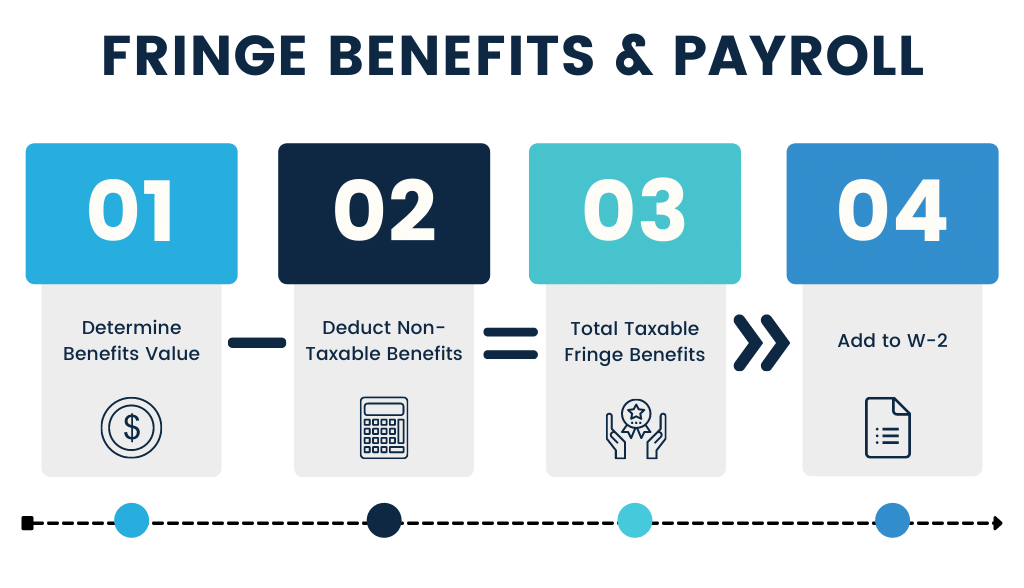

Fringe benefits are known as ‘imputed income’ in payroll processing. The IRS requires you to report the taxable portion of the fringe benefit’s total value. As an employer, you can choose to make these tax deductions monthly, quarterly, semi-annually, or an annual lump sum.

The first step to calculating fringe benefits on your employee’s payroll is determining the total value of the benefits they receive. Deduct any non-taxable fringe benefits from the value, including relevant benefits that are tax-exempt up to a particular value. The amount you get after the deductions is the total taxable fringe benefits. You will then add that amount to your employee’s Form W-2.

How APS Can Help

We understand that recording fringe benefits in payroll can be a tedious task, primarily if not every employee receives the same benefits. Manually reporting each employee’s taxable and non-taxable benefits is not only time-consuming but may also result in errors.

With APS’ automated payroll solution, you can automate the management of your employees’ fringe benefits:

- Once you obtain the fringe benefit amounts from your CPA, our support team can help you determine the desired withholdings*.

- Those withholding amounts are added to our payroll system as income items during payroll processing.

- When processing your payroll, you have the flexibility to add applicable fringe benefit items.

- Save recurring fringe benefits as income defaults that automatically populate your payroll batch for each pay period.

Utilizing our cloud-based payroll platform makes you less likely to encounter errors and risk non-compliance fees by eliminating this manual process.

To find out how APS can make payroll processing more manageable for you, request a demo with us today.

*APS does not calculate the amount of income for each fringe benefit on behalf of customers. Please contact your CPA for guidance on calculating your company’s fringe benefits.