Avoiding W-2 Errors

Payroll and HR managers work hard to produce accurate Form W-2s. However, even the most thorough efforts can raise questions and bring potential problems to light. Mistakes happen to the best of us, and it’s not always easy to avoid W-2 errors. So what do you do when an error occurs on an employee’s Form W-2, Wage, and Tax Statement? Better yet, how can you avoid these errors in the first place?

This article breaks down the top ten most common Form W-2 errors and how to correct them so you can avoid potential fines today.

Common Errors on Form W-2

1. Excess Contributions to a Health Savings Account

What do you do if you make excess contributions to an employee’s Health Savings Account (HSA)? Excess contributions are any amount that exceeds the 2021 maximum of $3,600 for self-only coverage or $7,200 for family coverage. You can correct excess contributions in the following ways:

- Request a return of excess funds from the financial institution to get refunded to the employee. Then, issue a Form W-2c, Corrected Wage and Tax Statements, showing the reduction in the amount reported in box 12, Code W.

- If you chose not to recover the excess contributions, report those funds as taxable wages on Form W-2, boxes 1, 3, and 5. Boxes 4 and 6 show the Social Security and Medicare tax owed on the excess amount. If this is not recorded correctly on Form W-2, then a Form W-2c must be issued.

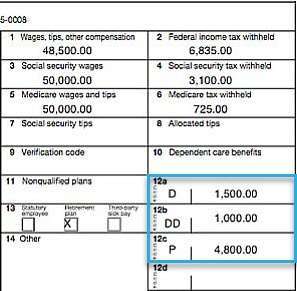

Form W-2: Box 12, Code DD Information

A common question we hear is, “What is Code DD on Form W-2?” Employers use this code to report the cost of an employee’s health care benefits. It’s reported in Box 12 of Form W-2 and using Code DD to identify the actual amount. This reported amount generally includes the portions paid by both the employer and the employee. However, it doesn’t include any salary reduction contributions. The amount recorded for Code DD is not taxable and is for information purposes.

Not sure what to report on Box 12?

Click here to find out!

2. Excess Contributions to Qualified Retirement Plan

Qualified retirement plans include 401(k)s and 403(b)s. Excess contributions are not reported on a Form W-2 but on a Form 1099-R. If excess contributions are made, it’s the employee’s responsibility to communicate information to their trust plan administrator to make a corrective distribution plan.

Note:

Remind employees the deadline for trust plan administrators to make adjustments is April 15th, 2022.

3. Excess Contributions to a Flexible Spending Account

Here’s what to do if an employee’s pretax contributions exceeded the 2021 FSA limit of $2,750. Refund the excess amount to the employee and the amount recorded as taxable wages in Form W-2c, boxes 1, 2, and 5.

The employer is liable for any Social Security and Medicare tax not withheld and must pay the employer portion to the IRS. Organizations are also responsible for any federal income tax and Additional Medicare Tax not withheld. Employers can reduce their federal income and Additional Medicare Tax liability by utilizing Form 4669. Employees fill out a 4669 form to report on tax payments made. Employers use the form to show they are entitled to relief.

Add Your Heading Text Here

The American Rescue Plan Act raised the pre-tax contribution limits for dependent care flexible spending accounts (FSAs). In 2021, single taxpayers and married couples filing jointly could contribute up to $10,500. Married individuals filing separately could contribute up to $5,250.

If an employee’s contribution was more than these amounts, it must be subject to FIT, FITW, FICA, and FUTA. Employers must also refund the excess to the employee and the amount reflected as taxable wages in Form W-2c, boxes 1, 3, and 5. There must also be an entry in Form W-2c, box 10, reflecting the employee’s decrease for the amount refunded.

Employers are liable for any FICA taxes withheld, federal income tax, and Additional Medicare Tax. They are also responsible for paying the exceeded amount to the IRS. Liabilities for the Additional Medicare Tax and federal income, not the penalties, can be subsided by obtaining Form 4669 from the employee.

5. Missing or Incorrect Name or Social Security Number

The IRS requires employers to correct errors in an employee’s name or Social Security number (SSN). Errors include:

- Leaving an employee name blank

- Leaving an SSN blank

- Showing the SSN as “000 00 0000”

- Showing the SSN as “applied for” after receiving a valid SSN from the employee

If any employee has changed their name due to a marriage or divorce, they must furnish a new Form W-4. If the employee’s last name on Form W-4 differs from their Social Security card, they will need to check box 4 on Form W-4.

The method for correcting these errors depends on the circumstances:

Nature of Error | Correction to Form W-2c | Correction to Form W-3c |

|---|---|---|

An employee incorrectly reported a name or SSN on Form W-2. | Complete boxes d-i for up to the statute of limitations. Tell the employee to correct the Form W-2 attached to Form 1040. | Complete boxes d-j for at least up to the statute of limitations.

|

Employee obtains new or reissued Social Security card. | Complete boxes d-i only for the most current year. | Complete boxes d-j only for the most current year.

|

Name and SSN were blank on Form W-2. | Call the Social Security Administration for instructions. | Call the Social Security Administration for instructions.

|

6. Incorrect Employer Name or Address

Error Alert!

The IRS requires that employee Form W-2s and Form 1095-Cs must match what is printed on their social security cards. For example, if an employee has a hyphenated last name on their social security card but it is not hyphenated on their Form W-2 or Form 1095-C, this will be considered an error.

An employer’s name and address should be the same across all tax forms. These include forms W-2, 941, 941-SS, 943, 944, CT-1, or Schedule H (Form 1040). If an employer needs to change their address, they need to obtain and file Form 8822-B with the IRS. Form W-3c cannot correct this type of information.

If the only error on Form W-2 is the employee’s address, the employer has three options for correcting the error.

- Give the employee a corrected Form W-2 with a “reissued statement” printed on it.

- Mail the original Form W-2 to the employee’s correct address.

- Give the employee a Form W-2c showing the correct address and all other correct information. See number 5 above for how to correct an incorrect employee name on Form W-2.

Note:

Employers should not file Form W-3c with the SSA (unless you are correcting other errors on Form W-2.)

7. Incorrect Reduction in Federal Income Tax Withholding in Connection With a Gross-Up After the Tax Year Closes

According to the IRS Chief Counsel Advice (CCA), a prior year gross-up of income tax represents tax withheld, even if the employer paid the tax on behalf of the employee through the gross-up. The CCA also states that employers can’t claim refunds above federal income tax withholdings remitted in a prior calendar year due to a gross-up.

The CCA advises that any federal income tax refund must be claimed on employees’ federal individual income tax returns, as reflected in the Form 941-X instructions.

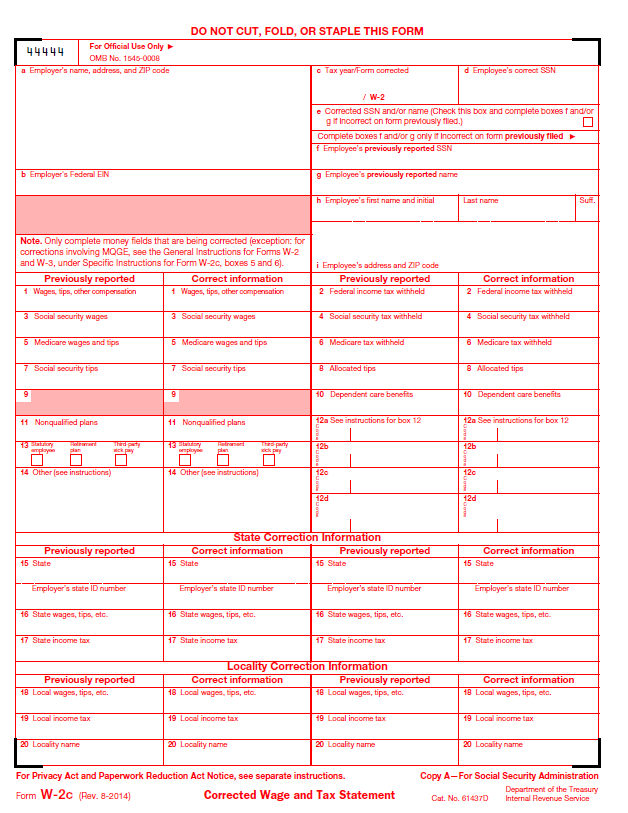

8. Incorrect EIN or Tax Year

Step 1: Prepare Forms W-2c and W-3c with the Previously Reported Information

- Provide the incorrect EIN in box b and the incorrect tax year in box c.

- Show the money amounts originally reported in the previously reported column.

- Show zeros in the corrected amounts column

Step 2: Prepare Forms W-2c and W-3c with the Correct Information

- Provide the correct EIN in box b and the incorrect tax year in box c.

- Show zero in the money amounts of the previously reported column.

- Show the money amounts originally reported in the corrected amounts column.

Ensure employees receive a copy of Forms W-2c and file Forms W-2c and W-3c with the Social Security Administration (SSA).

Wage and Tax Statement Form W-2c

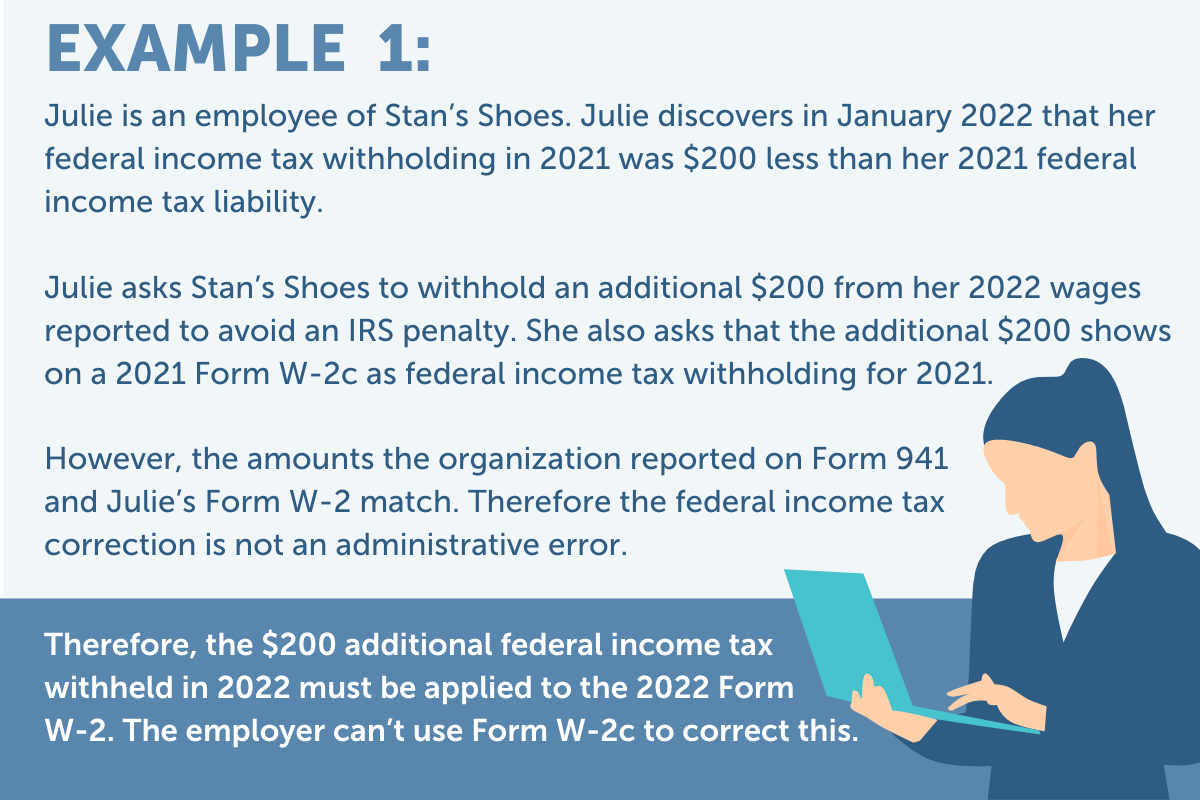

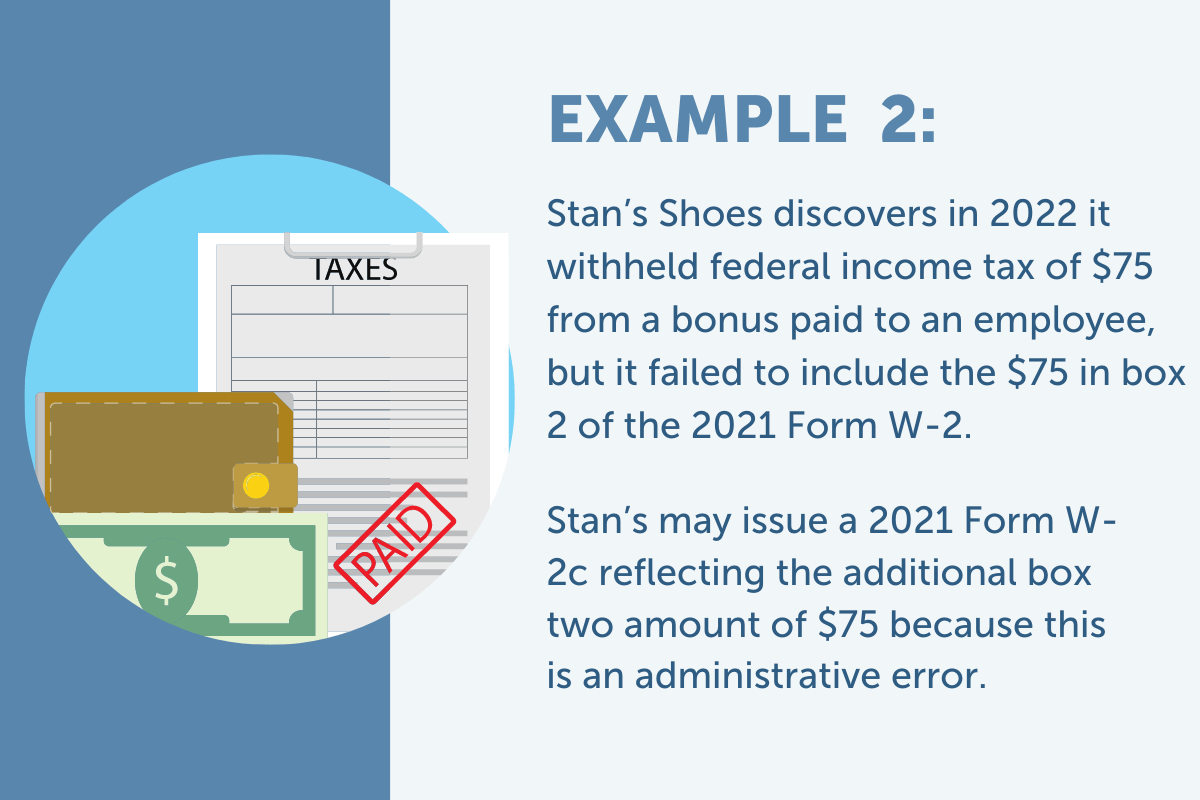

9. Error Withholding Federal Income Tax or Additional Medicare Tax

The IRS does not allow you to correct reporting of federal income tax or Additional Medicare Tax withheld on a Form W-2 from previous years unless it’s “administrative.” If the amounts shown on Form 941 don’t match the organization’s withholding, that’s an administrative error. Because it’s administrative, the organization can correct the error.

The IRS does not allow an employee to have a federal income tax or Additional Medicare Tax withheld from current employee wages to correct under- or over-withholding in a previous tax year.

10. Excess Social Security or Medicare Tax Withholding

You might be wondering if you’re required to correct a Form W-2 that shows excess FICA withholding or if the employee can request a refund of the excess FICA directly from the IRS. The IRS expects employers to refund any excess FICA withheld on behalf of an employee. Employers need to issue Form W-2c showing the correct FICA withholding.

When you refund FICA tax overpayments to the employee, make sure you receive certification that the employee has not and will not claim a refund of the excess contributions on their income tax return. Once you receive this certification, you may file Form 941-X with the IRS requesting an adjustment or refund for the employee and employer overpayment of Social Security and Medicare.

Form W-2 Frequently Asked Questions:

Employers can reissue a Form W-2 using either the IRS official form or an acceptable substitute that meets the requirements published in IRS Publication 1141. The deadline for providing federal Forms W-2 to employees (February 1, 2022, for the tax year 2021) applies only to the original issuance.

The IRS doesn’t specify a timeframe to replace lost W-2s. While employers should be sensitive to employees’ federal, state, and local tax filing deadlines, there is generally no need to issue replacement forms on demand.

It is vital to fix this error as soon as you find it. If box 13 for “retirement plan” is checked in error, this could lead to the employee receiving notices from the IRS for additional tax assessments.

Use Form W-3c to correct this error by checking box 13, “retirement plan,” in the previously reported column and leaving it blank in the corrected amounts column.

When Should You Check Box 13?

Type of Retirement Plan | Employee Conditions | Should You Check the “Retirement Plan” Box? |

|---|---|---|

Defined benefit plan (i.e. traditional pension plan) | Employees qualify for employer funding into the plan because of age or years of service — even though the employee may not be vested or ever collect benefits. | Yes |

Defined contribution plan (401(k) or 403(b) plan, Roth 401(k) or 403(b) account, but not a 457 plan) | An employee is eligible to contribute but does not elect to contribute any money in this tax year. | No |

Defined contribution plan (401(k) or 403(b) plan, Roth 401(k) or 403(b) account, but not a 457 plan) | The employee is eligible to contribute and elects to contribute money in this tax year. | Yes |

Defined contribution plan (401(k) or 403(b) plan, a Roth 401(k) or 403(b) account, but not a 457 plan) | An employee is eligible to contribute but does not elect to contribute any money in this

tax year, but the employer does contribute funds. | Yes |

Defined contribution plan (401(k) or 403(b) plan, a Roth 401(k) or 403(b) account, but not a 457 plan) | The employee has contributed in past years but not during the current tax year under report. | No (even if the account value grows due to gains in the investments)

|

Profit-sharing plan | The plan includes a grace period after the close of the plan year when profit sharing can

be added to the participant’s account. | Yes |

Proactively Handle W-2 Errors

- Enter information only once, eliminating the potential for errors.

- Data sync between payroll, HR, attendance, and more, so information is always accurate and up-to-date.

- A cloud-based solution provides a secure, centralized database to store and protect sensitive data.

Form W-2 Penalties

The Internal Revenue Service (IRS) may impose a penalty for each Form W-2 with a missing or incorrect Social Security number or employee name. If there are errors, you would then be subject to the following penalties:

- $50 per Form W-2 if you correctly file within 30 days of the due date, with a maximum fine of $565,000 ($197,500 for small businesses).

- $110 per Form W-2 if you correctly file more than 30 days after the due date but by August 1, 2021; maximum penalty of $1,606,000 per year ($565,000 for small businesses)

- $280 per Form W-2 if you file after August 1, do not file corrections, or you do not file required Forms W-2; a maximum penalty of $3,392,000 per year ($1,130,500 for small businesses).

How APS Can Help You Avoid W-2 Errors

At APS, we’re passionate about making payroll and HR easier for our clients. Our unified solution has a built-in Form W-2 error-checking algorithm that reviews all W-2s and identifies potential errors based on current IRS error codes. It also allows you to correct errors before distributing W-2s to employees.

In addition to our error-checking algorithm, we have dedicated tax account experts on staff ready to help you with your compliance needs. We offer help with year-end processing and even have year-end payroll and HR guides available for you. Book a demo and learn more about how our software can help you today.