Healthcare employers can take advantage of different tax credits, depending on their circumstances. One of these incentives that can save businesses thousands of dollars is the Work Opportunity Tax Credit (WOTC) program. This federal tax credit program has been renewed and will continue to be available to companies until December 31, 2025. It is valuable to healthcare organizations open to hiring WOTC-eligible workers as it enables them to channel substantial savings into their businesses.

So, how does WOTC work for healthcare organizations? This article will explore the WOTC program and why it’s relevant for healthcare providers. We’ll also discuss the types of eligible employees, program benefits, and who should use this credit. Finally, we’ll discuss how recruiting and onboarding software can help you manage WOTC easily.

What is the Work Opportunity Tax Credit (WOTC)?

What is WOTC? The Work Opportunity Tax Credit (WOTC) is a general business credit designed to encourage businesses to hire specific groups of people who face significant obstacles to getting job offers. Employers get to lower their federal income tax liability by taking advantage of this tax credit. Meanwhile, WOTC-eligible workers can work towards becoming self-sufficient citizens with a steady source of income.

In healthcare, jobs like nursing, medical assistants, or senior care require a shorter duration to complete training or certification. The lower barrier to entry for such jobs is an opportunity for WOTC-eligible individuals who may be interested in healthcare jobs but have limited financial resources for advanced medical education.

As available job candidates fluctuate, businesses that hire WOTC-eligible individuals may benefit in two ways:

- First, companies are hiring from a pool of often ignored candidates. In doing so, they may find reliable healthcare talent otherwise unavailable.

- Second, hiring WOTC-eligible individuals helps businesses save thousands in tax credits.

How Much is the Work Opportunity Tax Credit Worth?

One of the more commonly asked or searched questions about WOTC tends to be: what is the federal work opportunity tax credit worth? The answer varies.

The tax credit you receive for each employee is calculated as a percentage of qualified wages paid during the first year of employment. You could claim a tax credit equal to 40% of a WOTC-eligible employee’s wages if they worked at least 400 hours in their first year of employment.

If they didn’t meet 400 hours but worked at least 120 hours in their first year of employment, your business can still claim a tax credit of 25% of the employee’s wages. Since there is no limit to the number of WOTC-eligible employees, the credits can add up to sizable savings for your business.

How Do You Qualify for the Work Opportunity Tax Credit?

To qualify for the federal work opportunity tax credit program, an employee must work a minimum of 120 hours in their first year of employment. You must wait until the employee accumulates 120 hours before filing for the WOTC. Without the minimum hours, you may not claim WOTC.

Additionally, the employee you hire must be a member of one of these targeted groups. We discuss these groups in more detail later in our article:

- Formerly incarcerated or those previously convicted of a felony;

- Recipients of state assistance under part A of title IV of the Social Security Act (SSA);

- Veterans;

- Residents in areas designated as empowerment zones or rural renewal counties;

- Individuals referred to an employer following completion of a rehabilitation plan or program;

- Individuals whose families are recipients of supplemental nutrition assistance under the Food and Nutrition Act of 2008;

- Recipients of supplemental security income benefits under title XVI of the SSA;

- Individuals whose families are recipients of state assistance under part A of title IV of the SSA; and

- Individuals experiencing long-term unemployment.

Furthermore, each eligible group of workers has a statutory maximum amount of qualified wages that are WOTC-eligible. The total credit per WOTC employee would be 40% of those statutory limits. Here’s a breakdown of the maximum credits available:

Credit Type | Credit Type |

|---|---|

Receives SNAP (food stamps) | $2,400

|

Veteran Eligibility Based on Disability (hired one year from leaving service) | $4,800

|

Veteran Eligibility Based on Disability (unemployed at least six months) | $9,600

|

Unemployed Veterans (at least four weeks) | $4,800

|

Unemployed Veterans (at least six months) | $9,600

|

All Other WOTC Target Groups | $2,400-$9,000

|

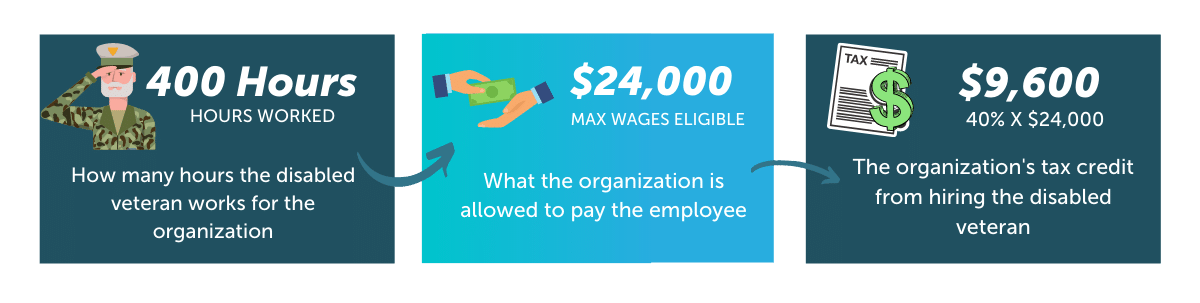

Here’s an example for a qualified veteran, one of the WOTC targeted groups of individuals.

You hire a disabled veteran who has been unemployed for six months in the one-year period ending on the hiring date. The employee performs at least 400 hours of service in their first year of employment, and the maximum eligible wages for such individuals is $24,000. Therefore, if you claim 40% of that amount, you will receive $9,600 in tax credits.

WOTC Groups Explained

In most cases, the maximum wages that qualify for the work opportunity employer tax credit is $6,000, though a few specific groups have higher or lower maximum wages.

Groups that meet the WOTC credit eligibility requirements are as follows:

These are veterans who served on active duty in the United States armed forces for a minimum of 180 days and have been discharged for at least 60 days. Additionally, they must meet at least one of the criteria below:

- Has a service-connected disability that entitles him or her to compensation and who is within one year of discharge (maximum WOTC-eligible wages of $12,000).

- Member of a family receiving Supplemental Nutrition Assistance Program (SNAP) assistance for at least 3 of the past 12 months

- A veteran who was unemployed for at least six months during the prior year (maximum WOTC-eligible wages of $14,000).

- A veteran who was unemployed for at least four weeks but less than six months during the prior year.

Who is Eligible for WOTC?

Employers of all sizes are eligible for WOTC, including taxable and tax-exempt. Eligible WOTC employers must be located in the United States and certain U.S. territories. According to the IRS, taxable employers claim the WOTC against income taxes. Eligible tax-exempt employers can claim WOTC only against payroll taxes and only for wages paid to members of the Qualified Veteran category.

To process WOTC-eligible employees, here’s the paperwork you may need:

- A confirmation letter from your state workforce agency showing an employee is eligible for these benefits.

- The completed pre-screening IRS Form 8850 from the eligible employee.

- A completed DOL Form 9061 after the employee starts work.

- A DD214 if your new hire is a veteran and an additional VA letter if the veteran is disabled.

How to Claim WOTC For Your Business

To claim WOTC for your business, you need:

- IRS Form 5884 for partnerships, S corporations, cooperatives, estates, and trusts.

- Or IRS Form 3800, the General Business Credit, for all other taxpayers and business owners.

It’s important to note that if you claim WOTC on employee wages, you cannot reuse them to claim other employee-based tax credits. They include Employer-Paid Family and Medical Leave Credits, Employee Retention Credit, forgivable Paycheck Protection Program loan proceeds, and other disaster retention credits.

Healthcare Employers That Can Benefit From the WOTC

Now that WOTC is explained, let’s discuss how healthcare employers can benefit from this tax credit. Employment in the healthcare field is highly competitive, with many health facilities vying for the same prospects. Selecting from a pool that often gets overlooked may help to fill those positions more quickly. Since there is no limit on hiring WOTC-eligible individuals, the amount of tax credits accumulated can be pretty significant.

Lowering your corporate federal tax liability is another advantage of WOTC. By using it strategically, you may even be able to eliminate your tax liability for many years. Employers can apply for the credit even when there is no tax liability, as unused credits can be carried back one year and carried forward for up to 20 years. Hence, you can save your credits for when there is tax liability.

Reducing your business’ costs means more significant profit margins and more money for expansion or new projects. Here are some types of healthcare facilities that benefit from WOTC:

Assisted Living Facilities

Staffing is a consistent challenge in assisted living facilities. Over three-quarters of assisted living operators surveyed by the American Health Care Association and National Center for Assisted Living (AHCA/NCAL) said their overall staffing challenges have become “much worse” or “somewhat worse” in recent years.

The survey results included responses from 1200 nursing homes and assisted living facilities. More than half the facilities are actively trying to fill vacant positions for certified nursing assistants (CNAs), licensed practical nurses, registered nurses, dietary staff, and housekeeping.

Nursing Homes

Nursing homes face similar staffing challenges as assisted living facilities. In the same survey conducted by the AHCA/NCAL, 94% of nursing homes said they could not fill all shifts without agency or ask staff to work extra shifts.

This report and others recently released highlight the urgency of addressing the shortfalls in the long-term care workforce. Hiring WOTC-eligible individuals is one way to help mitigate the shortage of long-term care workers and ensure that your facility provides adequate care to the senior population.

Rehabilitation Centers

Rehabilitation centers help patients with physical and mental issues for various reasons, such as disease or surgery. Therefore, it can be challenging to fill these positions while still ensuring patients receive quality care. Services provided at a rehabilitation center may include:

- Physical therapy

- Occupational therapy

- Nutritional guidance

- Mental health counseling

With a wide range of services offered at rehabilitation centers, many of these positions can be filled by WOTC-eligible individuals once they’ve completed the necessary training and certification.

Home Health Care Agencies

According to the Bureau of Labor Statistics, home health care is one of the fastest-growing industries, with a projected growth of 34% from 2019 to 2029. With a large number of positions available in home health care, this is the right time to apply for WOTC benefits.

Home health care agencies offer a range of senior medical services by trained professionals. Care is provided at the patient’s home, and the agency does not need to be located in the home city to provide care. Therefore, home health agencies can cast a broader net in the WOTC targeted groups pool to find quality candidates.

How APS Can Help You Navigate the WOTC Program

WOTC is readily available to qualifying healthcare facilities, yet many do not take advantage of it. Increased candidates and employees mean additional time and paperwork. Managing WOTC can seem overwhelming without a cloud-based solution to automate the process. The most effective way to manage this process is to utilize recruiting and onboarding software that integrates with a tax incentive solution.

APS’ employee recruitment and onboarding software for healthcare can automate your medical facility’s hiring process. Recruit candidates, track applicants, and onboard new employees, all in the same solution. During the onboarding process, use our ancillary service provided by Synergi to screen for WOTC-eligible employees automatically. Our software and services for healthcare facilities ensure that you:

- Streamline your recruiting process

- Hire the right people

- Take advantage of maximum federal, state, and local hiring-related tax credits

- Reduce your onboarding time

Contact us today to learn more about how APS can help your healthcare facility automate its payroll and HR processes.