HR Software for Nonprofits

Nonprofit Payroll Software that Makes a Difference

We know the importance of flexibility when it comes to managing fund accounting, special taxation issues, and reporting needs. You need HR software for nonprofits that streamlines manual, paper-based processes so you can focus on your mission.

Nonprofit HR Solutions

We understand the importance of managing time tracking, labor distribution reporting, and regulatory compliance.

Payroll Tax Compliance

Fund Accounting

Employee Benefits

Labor Management

Integrations

Worker Classifications

Intuitive Reporting

Centralized Database

Key Features of HR Software for Nonprofits

- With our payroll software for nonprofits, you can automate your open enrollment process and manage your health benefits administration in one system.

- Employees can enroll in health, dental, vision, and more using our intuitive, guided workflow.

- Enrollment information is saved to the employee record automatically, eliminating duplicate data entry and potential errors.

- Send benefits enrollment data and relevant updates to your providers automatically with our carrier feed integrations.

- Track qualifying events, meet coverage requirements, and reduce non-compliance fees with our automated COBRA administration.

- Receive alerts for missed punches with our payroll services for nonprofits.

- Get notified about employee time-off requests automatically for a more efficient process.

- Always know when your employees are in or approaching overtime with our nonprofit HR solutions for more proactive management.

- HR software for nonprofits allows you to utilize various time capture options, including mobile and biometric, for better control over labor costs.

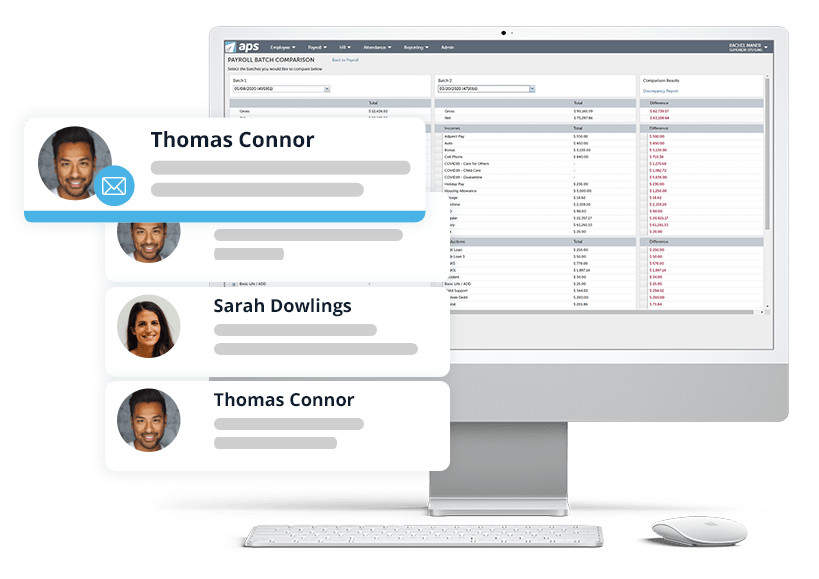

- Our HR and payroll for nonprofit organizations provide quick access to employee information.

- Track essential staff data for your nonprofit, including performance reviews, pay rate changes, benefits, and any other type of employee record information.

- Employees can access their payroll and HR tasks using our self service mobile app.

- Track necessary staff and volunteer information for your nonprofit organization.

- Use real-time analytics and dashboards to gain visibility into your nonprofit’s metrics like labor costs and overtime so you can maximize every dollar.

- Utilize our built-in Affordable Care Act solution to help you manage compliance for your nonprofit.

- HR software for nonprofits makes it easy to gather the information needed for reporting and use that data to file forms with the appropriate agencies to mitigate risk.

- Leverage global reporting for actionable insight across locations, and automate report delivery by email.

Nonprofit HR Software Integrations

We offer imports, exports, and integrations with accounting, general ledger, and 403(b) systems so you can get the most out of your investments.

Download Our Guide on Payroll Software for Nonprofit Organizations

Biggest Pain Points for Nonprofits

The biggest pain points that HR departments at nonprofit organizations deal with are managing overheard, regulations, payroll taxes, worker classifications, and volunteers. Here’s how we’ve helped rehabilitation groups, social advocacy organizations, and other foundations solve these challenges by providing the best HR software for nonprofits.

Payroll Taxes

Payroll taxes for nonprofit organizations are more complicated than they are for other types of businesses. It’s overwhelming managing which payroll taxes nonprofits pay and remitting the correct amounts to different government entities. Payroll taxes for nonprofits require additional expertise to meet compliance standards and maintain 501(c)(3) tax-exempt status.

APS’ team of certified payroll tax compliance experts understands the nuances associated with nonprofit payroll taxes. We use a defined process for the daily management of nonprofit tax funds to ensure accurate payroll tax filings and payments. We provide the best payroll services for nonprofits and can help you in the following ways:

- Managing multiple pay groups accurately and efficiently

- Helping you with tax compliance government regulations

- Maintaining the employee lifecycle from start to finish within a single system

- Administering benefits to your staff, including online open enrollment

- Automating time tracking with payroll by utilizing online time capture options and employee time allocation tools

Managing Overhead

Managing overhead is one of the biggest challenges for nonprofit organizations. Nonprofits have to make every dollar count and use their resources strategically. With APS Dimensions, nonprofits can closely monitor employee hours related to grants, so you know how much time and money are spent. This automatic allocation of employee time makes it easier for nonprofits to keep track of grant spending for budgetary purposes.

APS’ reporting and analytics solution takes labor cost tracking a step further. With analytical tiles and dashboards, HR managers get an instant view of critical labor data like overtime turnover for more proactive management of overhead.

Regulations

Nonprofit organizations are subject to federal, state, and local regulations that for-profit businesses are not. These regulations create additional work for nonprofit HR departments, on top of everything else they need to manage.

APS’ nonprofit payroll software captures your critical payroll information accurately to ensure you’re compliant. With easy access to your quarterly tax packets and CARES Act employee retention credit, you can rest assured your nonprofit is compliant. Our expert tax compliance team alleviates the burden of staying on top of complex and ever-changing regulations so you can maintain your tax-exempt status.

Worker Classifications and Volunteers

Nonprofit organizations deal with an extra layer of worker classification due to the heavy involvement of volunteers, in addition to employees and contractors. You can configure our nonprofit HR software to track and manage all of your worker classifications and volunteers.

Track hours worked, emergency contacts, and certifications accurately to save time and mitigate risk. Volunteer hours can then be tied to grants using either APS Dimensions or our native integration Sage Intacct Dimensions to ensure you meet budgetary requirements.

Using our payroll software for nonprofit organizations also ensures you provide Form W-2s and 1099s to the appropriate workers. Run reports to review employee classifications for full-time, part-time, and volunteer staff to comply with FLSA overtime rules.

A Support Team that Really Cares

HR software for nonprofits should create an enjoyable and personalized experience for HR employees. With a role-based configuration, each user can make the most out of their workday. When the best payroll software for nonprofits is easy to use, your people actually use it.

Your dedicated four-person team is available via email, phone, and support requests to answer your questions promptly. You’ll also have access to our Help Center’s articles and videos for learning at your own pace. Our customers also receive lifetime training at no additional cost.

Request Customized Nonprofit Payroll Pricing

APS: Trusted Outsourced HR for Nonprofits

APS works with nonprofit and charitable organizations across the country, so we understand what matters most to you. Our goal is to provide the best payroll software for nonprofit organizations and meet your specific needs, including:

- Managing multiple worker classifications accurately and efficiently

- Helping you with nonprofit tax compliance government regulations

- Providing the tools you need to manage your overhead and stay within budget

- Administering benefits to your staff, including online open enrollment

- Automating time tracking with payroll by utilizing online time capture options and employee time allocation tools

Suggested Resources for Nonprofits

We have informational resources and tools for all your workforce management needs. Check out our handy articles, checklists, eBooks, guides, industry overviews, reports, and white papers with valuable information about Core HR and Payroll.