Payroll Software for Startups & Tech Companies

Helping Tech Companies Develop Effective HR

We know the importance of flexibility when it comes to managing remote employees, benefits administration, and recruiting top talent for your technology organization. You need payroll software for technology companies that streamlines manual, paper-based processes so you can focus on growing your business.

HR Software for Startups

Mobile Management

Employee Benefits

Flexible Scheduling

Integrations

Recruiting & Onboarding

Intuitive Reporting

Automated PTO and Attendance

Payroll Tax Compliance

Features of APS Payroll Software for Startups

- With APS Dimensions, you can allocate employee time by project, client, or contract to manage time and resources better.

- Automate your open enrollment process with our hr software for technology companies for a better employee experience.

- Our startup payroll software makes tracking training, certifications, and other essential employee events easier.

- Use real-time analytics and dashboards for cross-company snapshots of your startup’s performance, including turnover rates and overtime.

- Create goals for employees with payroll software for tech companies to provide clear direction for career development.

- Manage schedules and track attendance for employees across multiple locations and time zones.

- Utilize time clocks for stationary employees and our mobile clock-in app for remote workers.

- See real-time clock statuses to assess your remote workforce during the day instantly.

- Approve or deny time-off requests, online or via our mobile app, streamlining task management.

- Time tracking data syncs with your payroll to ensure accurate processing of tips, bonuses, and paychecks.

- Our cloud-based platform ensures your confidential company and employee data is protected.

- Utilize our SOC 1 Type 2 compliant payroll and HR software for technology companies to perform risk assessments and security audits on your behalf regularly.

- Gain peace of mind knowing your software communications are encrypted and layered with HTTPS for multi-level security.

- Ensure strict access control of our system with secure credential protocols like two-factor authentication and auto log-off.

- Utilize your business investments with our imports, exports, and integrations developed in-house.

- Continue using your invoicing software and financial management systems for more automated workflows.

- Work with our developers to create an integration for your management needs.

Integrations for Startups and Tech Companies

We offer imports, exports, and integrations with accounting, general ledger, and 403(b) systems so you can get the most out of your investments.

Download Our Guide on HR Software for Startups

Read more about how APS helps organizations like yours solve their most complex business issues by offering payroll software for startups.

Biggest Payroll Pain Points for Startups and Tech Companies

Maintaining a Pay Schedule

At APS, we understand the complexity of maintaining a pay schedule for contractors, freelancer workers, and employees. That’s why we offer cloud-based payroll solutions enabling you to schedule and pay any type of worker accurately.

The data in our attendance platform helps you stay on track with your payroll schedule and budget. Pay workers at different rates and frequencies as needed. Receive alerts when it’s time to process payroll. Whether paying employees or contractors, our best payroll services for startups ensure your workers are paid accurately and timely.

Managing Remote Workers

Many technology companies rely on remote workers to help complete projects. However, remote work payouts can get confusing depending on where the person lives and your company’s location. That’s why we offer an HR and payroll service for startups and technology companies that alleviates this burden and makes it easier to manage your dispersed workforce.

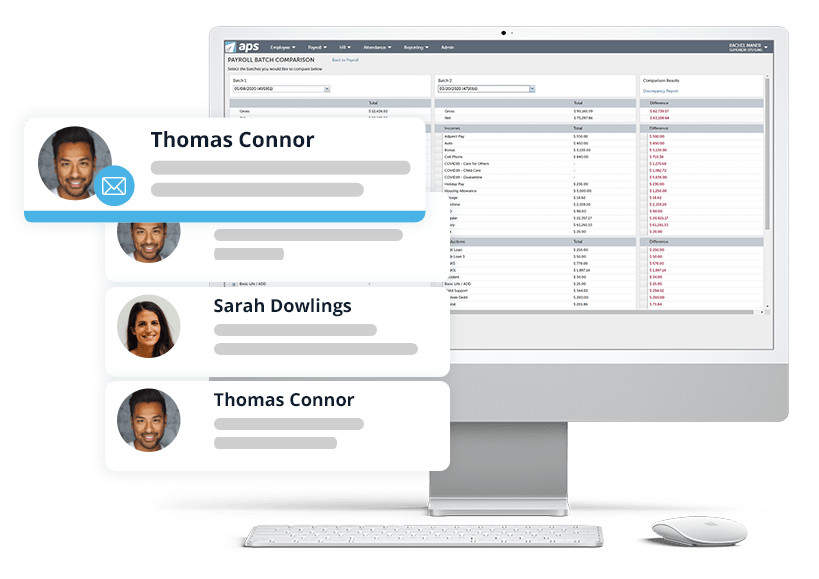

We help reduce these complexities by offering tech and startup payroll benefits via mobile management. APS Mobile empowers employees and managers to stay in touch and complete HR processes and tasks from their preferred device. Employees can clock in and request time off through our convenient mobile app. Managers can approve schedules and time-off requests and see employee information on their mobile phones.

APS also helps organizations handle taxation for remote workers across various industries. We monitor federal, state, and local tax regulations across the United States and even file them with the IRS on your behalf. We work to minimize tax burdens so you can spend that time focusing on your most important asset, your people.

Classifying Employees and Freelancers

As a payroll or HR manager, you can spend a lot of time correctly classifying workers. It isn’t always easy to know which tax forms to use for independent contractors and full-time employees. Luckily, we design our HR and payroll startup software to help you properly navigate the compliance of your workforce, including:

- Multi-factor time tracking to allocate contract or freelance time by assigned project, task, or other dimensional categories.

- A dedicated team of tax compliance experts can help you choose and file Forms best for each employee, including but not limited to W-2, W-3, and 1099-NEC.

- Management of various payment types like RROP (regular rate of pay), part-time, and other forms of income.

- Accurate classification of employees and contractors, so W-2 and 1099 information are accurate and up-to-date.

Mixing Personal and Business Expenses

It’s common for startups and tech companies to accidentally mix personal and business expenses during tax reporting. APS helps you avoid these kinds of tax-related problems with our best HR software for startups.

Our comprehensive payroll imports, exports, and integrations help you avoid mistakes associated with data fatigue. Utilizing our integrations enables you to combine your payroll, HR, and financial data. Simplifying data reduces errors and saves you hours inputting data or exporting information between two systems.

Assign GL codes from your accounting system to various payroll items and departments in our platform so you can make informed financial decisions and manage expense tracking easily.

We also offer a native integration with Sage Intacct to better align your payroll and finance data. If you don’t use Sage Intacct, you can use APS Dimensions for automated employee time allocation.

When employee and company data transfers between payroll and financial solutions, compliance becomes more manageable for human resource management in startups.

Best-in-Class Support for Startup Payroll & HR Software

We developed user-friendly payroll software for startups, software companies, IT services and consulting firms, and communications businesses. Our tax compliance experts can help you manage and file remote worker taxes to maintain compliance. Meanwhile, your dedicated account team is there to assist you with any payroll and HR questions you might have.

Everyone in your company can have an enjoyable and personalized experience with our platform. Whether you’re managing remote workers or maintaining classification compliance, we’re here to help.

Did we mention we’ve earned an award two years in a row for Technology that Cares?

Request Customized Payroll Pricing for Your Tech Company

APS Understands the Tech and Startup Industry

We understand your industry needs as a tech software company and former startup ourselves. We’ve developed Dashboards for your company’s essential data needs. Proactively manage compliance with your data all in one place. Our platform also allows for quick adoption, so everyone can get things done from day one and move on to more critical tasks.

Accessing real-time information at your fingertips means better collaboration and decision-making. Meanwhile, a configurable solution means each user can make the most of their workday. When solutions are easy to use, your people use them.