Everything You Need to Know About Gross Pay and Net Pay

When employees take home their first paychecks, you might receive several questions related to their adjusted wages. First-time employees are often surprised to discover that working for 20 hours at $20 per hour doesn’t equal $400. As a result, the gross pay vs. net pay gap can be shocking.

Gross pay and net pay are two terms that can be confusing for both payroll administrators and employees alike. However, because they affect employee wages, tax records, and employer taxes, it’s necessary to understand the difference between gross pay and net pay.

We’ll use this article to explain the difference between the gross pay and net pay of an employee. We’ll also include details and examples for calculating gross and net pay for both salary and hourly employees. From there, we’ll offer tips employers can use to explain gross income vs. net pay to employees. Our goal is to help you understand the difference between gross wages vs. net pay, calculate them, and learn how gross and net pay impact voluntary deductions, tax withholdings, and employee wages.

What’s the Difference Between Gross Pay vs. Net Pay?

What is Gross Pay?

Gross pay is the amount of money an employee receives before taxes and deductions are taken out of the employee’s paycheck. Gross income usually comes in the form of hourly compensation or an annual salary. The amount can’t be lower than the federal minimum wage or a state’s minimum wage. For a complete list of United States minimum wages, click here.

Regardless of the wage type, gross pay is the accepted monetary amount that an employer offers a potential employee. It is the known amount agreed upon before a new job, promotion, or transfer acceptance. For example, if your potential employer states your salary is $50,000 a year, your gross wage will also be $50,000.

What is Net Pay?

Employers often refer to net pay as “take-home pay.” This term is because the net gain is the dollar amount an employee takes home after deductions like federal and state income taxes are subtracted from the employee’s gross wages. While most net pay deductions are legally required, several other deductions employees may opt for include health insurance and retirement savings amounts.

Because net pay includes mandatory and voluntary deductions, it is always lower than an employee’s gross pay. For example, an employee’s gross salary could be $50,000, but his or her take-home pay may only come out to $42,000. The good news is employees don’t have to worry about manually making these calculations. It’s up to employers to handle the process of taking out deductions from worker paychecks.

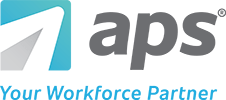

Calendar example of the total number of pay periods based on different frequencies of pay

How to Calculate Gross Pay for a Salary Employee

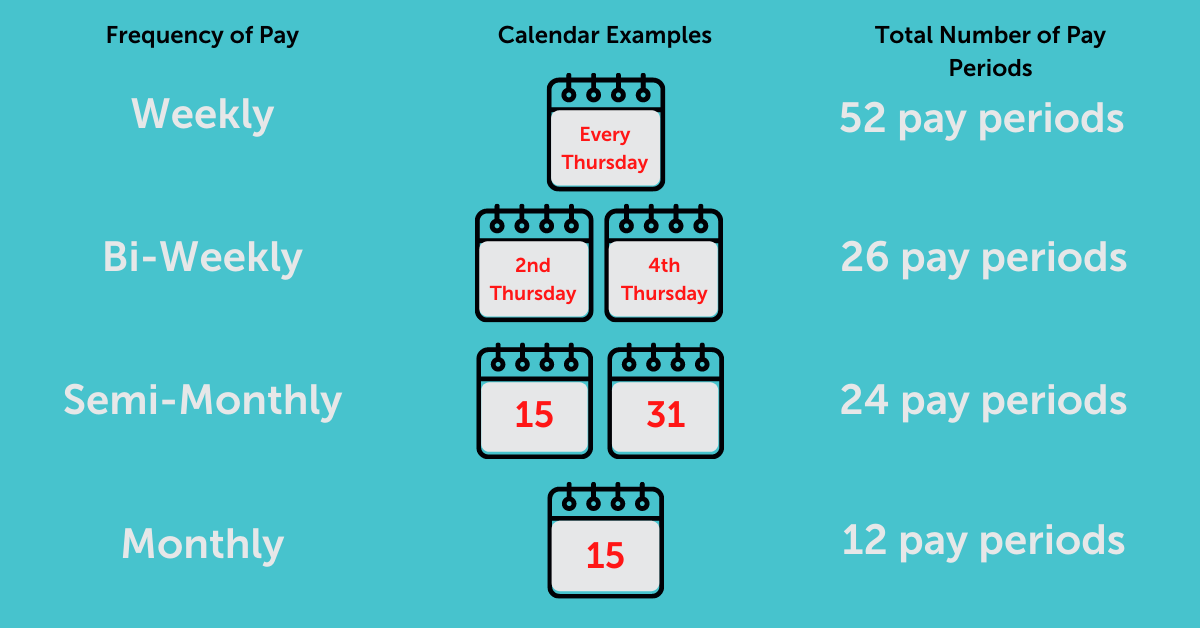

Once you determine your organization’s pay frequency and the number of pay periods, divide your employee’s annual salary by that number.

For example, Ben’s salary is $55,000 a year. He is paid semi-monthly for a total of 24 pay periods. If you divide $55,000 by 24, you can calculate Ben’s gross wages per payroll: $2,291.67.

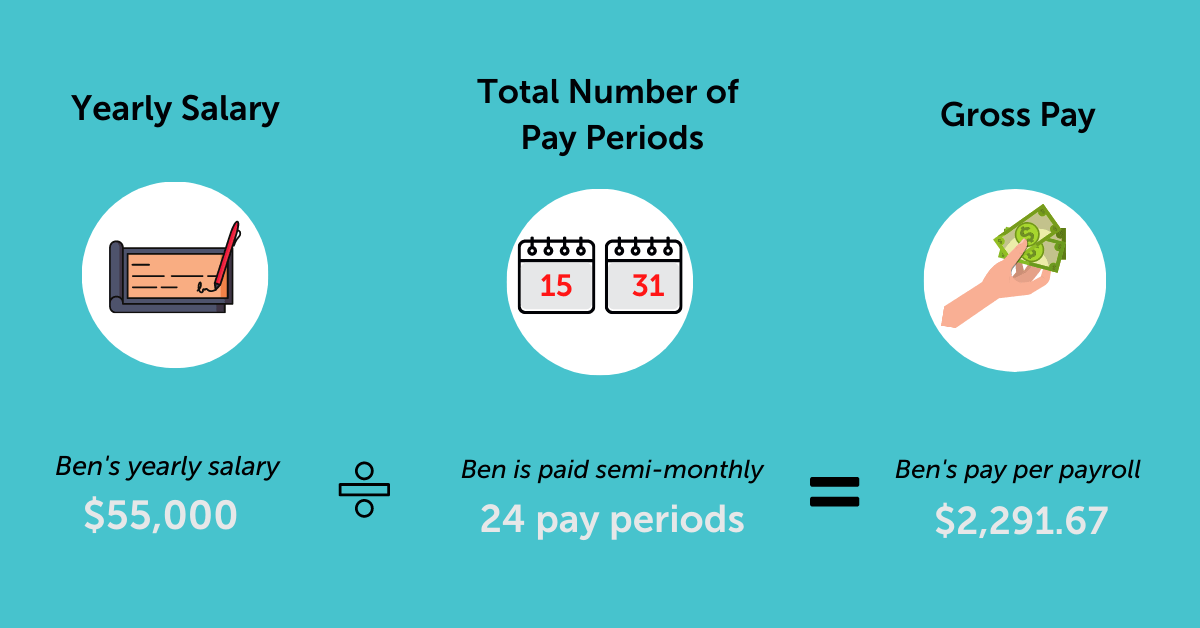

How to Calculate Gross Pay for an Hourly Employee

Calculating gross pay for an hourly employee is not much different than calculating it from a salaried employee. There, however, are a few more pieces of information needed for an hourly calculation. To calculate gross pay for an hourly employee, you will need the employee’s hourly rate and the number of hours an employee has worked in a particular pay period. Then, follow these steps:

- Multiply the employee’s hourly rate by his or her number of hours worked.

- Determine if the employee has other income streams like commissions, tips, or overtime pay.

- Add those additional incomes to your total.

Need Help Automating Calculations?

How to Calculate Net Pay From Gross Pay

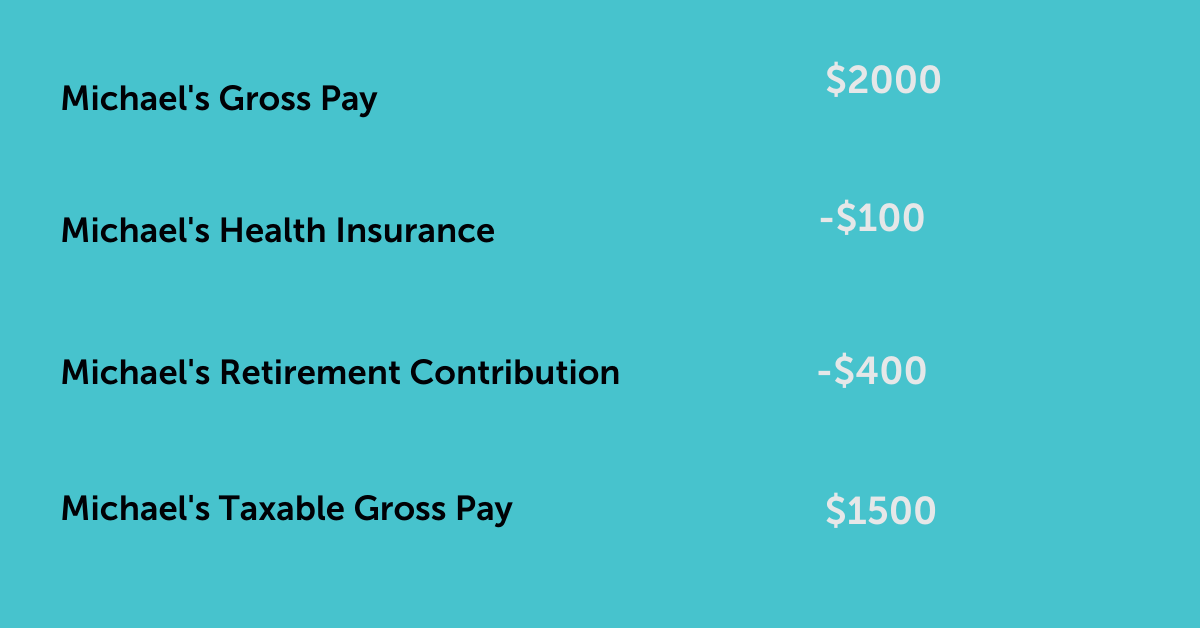

1. Subtract the Pre-Tax Deductions

Pre-tax deductions are monetary amounts withheld from an employee’s gross pay before taxes are taken out of the employee’s paycheck. Pre-tax deductions reduce an employee’s taxable income, resulting in the worker owing less money to state and federal governments in the form of income taxes.

In addition to owing less in income taxes, an employee may owe a lower amount of FICA, Social Security, and even Medicare taxes too. Pre-tax deductions can also lower mandatory employer taxes such as Federal Unemployment Taxes (FUTA) and State Unemployment Taxes (SUTA). These deductions are often optional and voluntary; and, there are several types, including, but not limited to:

- Child-Care contributions

- Dental benefits

- Health insurance premiums

- Job-related expenses

- Life insurance premiums

- Retirement contributions

- Short-term or long-term disability

- Tax-deferred investments

- Vision benefits

2. Subtract Mandatory Taxes

FICA Taxes

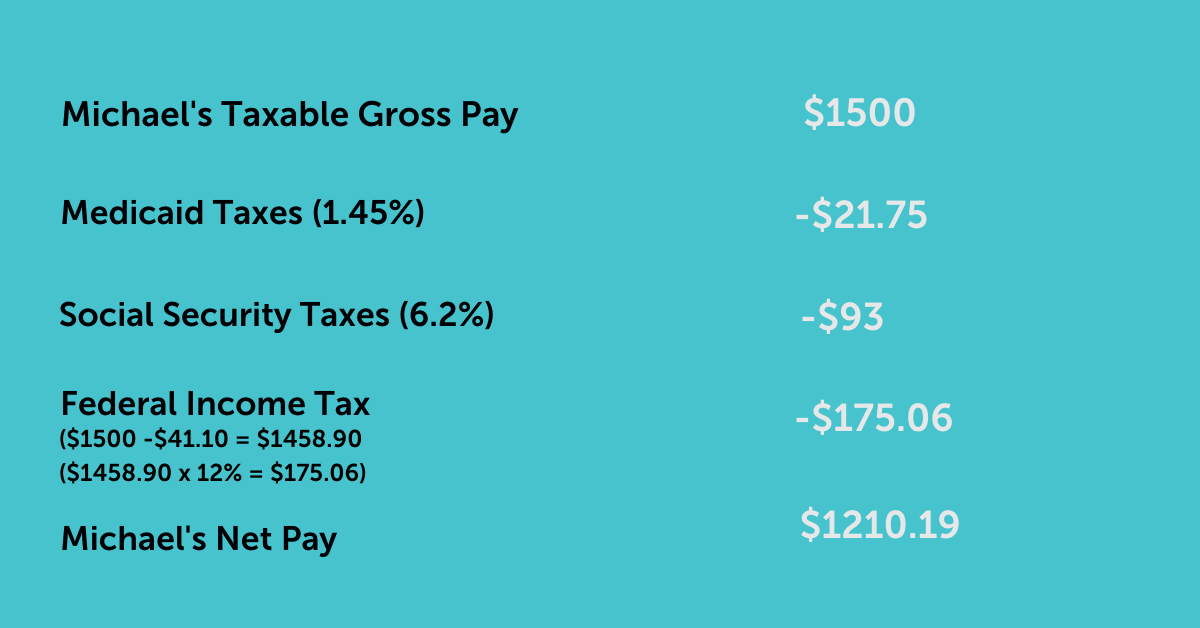

FICA is a U.S. federal payroll tax. It stands for the Federal Insurance Contributions Act and is deducted from each paycheck. FICA taxes make up 15% of an employee’s taxable gross pay. Employers pay half of this tax at 7.65%, and the employee pays the other half, which includes:

- Social Security taxes at 6.2%

- Medicare taxes at 1.45%

Federal Income Taxes

The U.S. currently has seven federal income tax brackets for different income levels. These brackets consist of tax rates ranging from 10% to 37%, depending on the level of taxable income an employee has. Federal income tax rates are progressive: As taxable income increases, it is taxed at higher rates. Different tax rates are levied on income in different ranges (or brackets) depending on the taxpayer’s filing status.

In 2020, the top tax rate (37%) applied to taxable income over $518,400 for single filers and over $622,050 for married couples filing jointly. Different tax schedules and rates apply to taxpayers who file as heads of household and married individuals filing separate returns. A separate schedule of tax rates applies to capital gains and dividends. Tax brackets are adjusted annually for inflation.

Source: Tax Policy Center Briefing Book

To determine an employee’s federal income tax status, you will need the following additional pieces of information:

- An employee’s filing status

- His or her withholding allowance

- The current IRS Income Tax Withholding Table, 15-T

Once you have an employee’s tax status, you can determine the mandatory taxable amount to take from their paycheck.

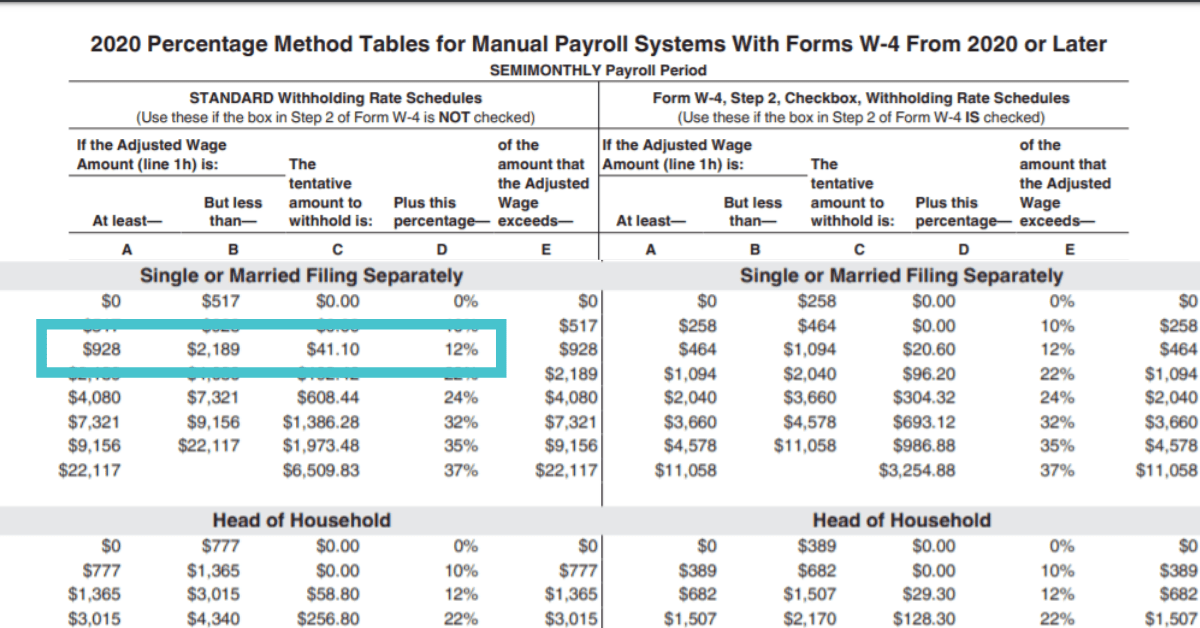

For example, Michael, whose pre-tax calculation we performed above, is paid semi-monthly and has a taxable gross income of $1500. He is single and has filed a 2020 Form W-4 with his employer. He has not checked the box in Step 2 of his W-4.

To calculate Michael’s net pay after FICA and federal taxes, we’ll determine the amount to withhold from his paycheck on the IRS 2020 Semi-Monthly Payroll Period Table.

3. Subtract Wage Garnishments

A wage garnishment is a legal term describing the process in which a person’s earnings are court-ordered to be withheld for the payment of a debt. Other types of standard garnishment procedures include IRS or state tax collection levies and federal agency administrative garnishments. These amounts are the final deduction an employer must take from an employee’s paycheck to determine the total net pay an employee will receive. There are several different types of wage garnishments, including:

- Back child support payments

- Delinquent student loans

- Nontaxable debts (e.g., credit card debt)

- Unpaid taxes

The amount of pay subject to garnishment depends on an employee’s “disposable earnings.” Disposable earnings are what an employee earns after legally required deductions. Disposable earnings not related to support, bankruptcy, state, or federal taxes have maximum garnishment withholding limitations. The weekly garnishment amount withheld from an employee’s paycheck can’t exceed the lesser of:

- 25% of the employee’s disposable earnings

- The amount by which an employee’s disposable earnings are greater than 30 times the minimum wage (currently $7.25 per hour).

For example, if the pay period is weekly and disposable earnings are $217.50 ($7.25 × 30) or less, there can be no garnishment. If disposable earnings are more than $217.50 but less than $290 ($7.25 × 40), the employer garnishes the amount above $217.50. If disposable incomes are $290 or more, the employer garnishes a maximum of 25%. When pay periods cover more than one week, the employer must use multiples of the weekly restrictions to calculate the maximum garnishment amounts.

Source: U.S. Department of Labor Wage and Hour Division

What do Gross Pay and Net Pay Mean for Employers?

Contributions Act (FICA) taxes. To determine that amount, you will need to know your employee’s gross pay.

You also need to calculate gross employee pay for FUTA. These are taxes that fund the unemployment program. Companies must pay 6% on the first $7,000 in gross pay per employee each year.

Payroll providers can help automate these manual processes to ensure calculations are accurate each payday. With tax compliance experts on staff, all-in-one workforce management platforms help employers avoid potential payroll and tax errors while mitigating legal risks.

Tips for Explaining Gross vs. Net Pay to Employees

For most employees, the confusion of gross pay vs. net pay is genuine. This confusion can often be a result of not understanding taxable wages and take-home pay. Employers can help workers navigate these challenges through the following ways:

- Incorporate a gross pay and net pay overview talk into your onboarding program.

- Encourage employees to assess the current information on W-4 forms.

- Have employees utilize tax forms to calculate deductions for the upcoming tax year per new tax guidelines.

- Tell employees to re-evaluate W-4 forms annually and verify that deductions are accurate.

- Encourage employees to make adjustments to tax forms based on life situations such as marriage, divorce, birth, children turning 18, etc.

- Have employees view take-home wages based on their previous tax form adjustments.

- If further questions arise, tell employees to get with their HR manager for a more detailed explanation.

Once you have encouraged employees to make regular adjustments to their tax forms, their wages can reflect their current situation more accurately. From there, workers can make informed decisions around their take-home wages instead of their known annual salaries.

Gross Pay vs. Net Pay Recap

Whether your employees have questions about their paychecks or you’re handling payroll taxes for your company, understanding the difference between gross pay and net income is essential. Remember, gross wages are before taxes, and other deductions are taken out. Net pay is a wage paid after taxes and other deductions. Knowing the difference between gross salary and net pay can save both you and your employees from a world of headaches.

When you know how to calculate pre-tax deductions, mandatory payroll taxes, and wage garnishments, your company avoids paying tax compliance fines. Additionally, when you understand the ins and outs of gross vs. net pay, you equip yourself with the tools necessary to educate your employees about their paychecks. Informed employees are happy employees because they can ensure they are paid accurately for their hard work.

How APS Can Help

APS has been providing payroll and tax compliance services since 1996. Our solutions experts are here to help with your payroll processing, including W-2s, 1099s, payroll taxes, automatic gross pay and net pay calculations, and ACA reporting. No matter what time of year works best for you, we’re here to make payroll and HR easier for you.

Please Note: This article should not be used as tax advice. Tax rules vary by location and change periodically, so please consult a CPA or tax advisor for guidance.